| Home | About Us | Resources | Archive | Free Reports | Market Window |

Where to Find Stocks That Triple in a YearBy

Tuesday, May 10, 2016

Since 1962, a total of 1,700 stocks (not including the tiny ones) have tripled in a 12-month period...

If we wanted to find the next stock to triple in 12 months, what should we do?

I say we should crunch some numbers to find out what stocks that triple in a year look like.

Fortunately, that work has already been done for us, by a few guys that I respect as much as anyone. I'm talking about the O'Shaughnessys.

Let me tell you why I trust them, and what they discovered about stocks that triple...

I consider What Works on Wall Street one of the most important books in Wall Street history.

No, it's not a thrilling page-turner. But it's full of numbers – very important numbers.

The author, Jim O'Shaughnessy of O'Shaughnessy Asset Management, tested every major strategy for investing in stocks over the last 50 years.

Here's how he did it... He had access to the deepest U.S. stock market database. And he tested every well-known stock-investing strategy (and many that were not so well-known) to find out what really works. He shared his results with the world in his book. (Thank you, Jim!)

Jim's son, Patrick O'Shaughnessy, is a chip off the old block...

He works with his dad as a portfolio manager at O'Shaughnessy Asset Management. Like his dad, Patrick likes to crunch numbers.

Earlier this year, Patrick wrote a blog post called "Stocks That Triple in One Year." Patrick did the math and found that 1,700 U.S.-traded stocks have tripled within one year since 1962 (excluding those less than $200 million in market value, adjusted for inflation).

He found that stocks that triple in a year have three things in common:

When I saw these shared characteristics, the first thing that came to my mind was the dot-com era of the late 1990s. Back then...

The dot-com era was a classic example of what Patrick discovered. But it wasn't the only "cluster" of occurrences... He also found that the cluster of big winners in the U.S. typically happened after a dramatic fall in the stock market.

The most recent example was in 2009. After stocks fell dramatically in 2008, a specific cluster of stocks tripled within the following year.

So... which sector in the U.S. historically has the most winners? By far, the tech sector...

Patrick's research uncovered a surprising conclusion:

To maximize our chances of finding a stock that could triple in the next 12 months, we should follow Patrick's formula. We need the following...

Patrick sums up what he learned:

(You can read more from Patrick right here.) Right now, the place we should be looking for triple-digit gains is in small-cap biotech companies. Today, they meet all of Patrick's criteria...

As Patrick says, good luck – you'll need lots of it – to find a stock that triples. But fishing in the small-cap biotech pond might be your best chance of landing the big one... Good investing,

Steve

Further Reading:

Longtime readers are familiar with What Works on Wall Street. Catch up on some of Steve's favorite lessons from it here...

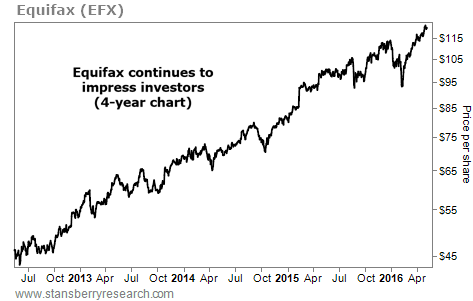

Market NotesIT'S A BULL MARKET IN IDENTITY PROTECTION Today's chart shows that one of America's three major credit-reporting companies is still going strong...

Equifax (EFX) – along with rivals TransUnion and Experian – is known for running credit checks on people. It sells that information to businesses that decide whether to approve you for a credit card, car loan, or mortgage. The company also offers services to help you keep a close eye on your credit score.

Last month, Equifax reported great first-quarter results. It also continues to grow in new areas, having just completed the purchase of Australian credit-information firm Veda Group in February.

As you can see, Equifax remains in a steady, long-term uptrend. Shares are up more than 160% in the past four years. They're up about 15% since acquiring Veda. The message is clear: Equifax's bullish uptrend continues...

|

Recent Articles

|