| Home | About Us | Resources | Archive | Free Reports | Market Window |

The 10 Ways to Find Your Next Great Investment OpportunityBy

Wednesday, June 29, 2016

Finding great investment ideas is hard work.

They don't just drop from the sky and say, "Here I am!" You have to uncover them.

Today, I'd like to help you improve your odds of finding great investments by briefly reviewing 10 classic setups that consistently produce winning ideas...

1. Companies with operating leverage

The idea here is simple: Look for companies where profits are growing faster than revenue.

Apple (AAPL) provides a perfect example. When the company introduced its ground-breaking iPhone a decade ago, revenue tripled in just four years, compounding at a remarkable rate of 33% per year. But earnings grew even faster, compounding at 58% per year, pushing the stock up fivefold.

Apple didn't have to triple the size of its operations to triple sales. Instead, it scaled the assets it already had by leveraging the excess capacity of its component suppliers. This is what enabled Apple to grow profits faster than revenue and exhibit operating leverage.

In contrast, the restaurant industry rarely demonstrates operating leverage. Every time Chipotle Mexican Grill (CMG) or Buffalo Wild Wings (BWLD) builds a new company-operated store, it has to fully equip and staff it. There's little opportunity to leverage these substantial costs, whether it's operating one or 100 stores.

2. Turnarounds

The right new manager can turn around an underperforming business and bring a fresh perspective to a company's challenges. When you hear about a company hiring a new CEO, watch for a potential turnaround setup.

3. Secular trends

Sometimes the herd actually gets it right. Look for emerging trends with the power to become secular, like e-commerce. Identifying the winners of these big trends early on can be extremely profitable.

Keep in mind there is a huge challenge to investing in big, secular trends: The winners, like Amazon (AMZN), rarely get close to anything resembling "cheap."

4. Underappreciated growth stories

My personal experience tells me this setup is as rare as politicians practicing fiscal restraint. Investors almost always overappreciate growth stocks, pricing them as if their current high, double-digit revenue growth will somehow continue on forever. Those rare instances when growth turns out to be greater than expected usually translate into wonderful investments.

5. Mischaracterized businesses

Investors sometimes develop inaccurate, preconceived notions about what a business really is. For instance, the stocks of many companies with only modest exposure to the oil and gas industry have been hit just as hard as those of companies with heavy exposure the past two years.

When you uncover a mislabeled business, you'll often find it has been mispriced as well. (As you look closer, it's important to consider what management could do to alter investor perception.)

6. Strong competitive position

Entrenched industries and niche-market leaders present great, stable opportunities, and many of Extreme Value's top recommendations have exhibited this trait. For instance, nobody imports more beer to the U.S. than Constellation Brands (STZ) or earns more profits selling smartphones than Apple.

Strong competitive positions don't happen overnight. Consistent operating margins over a long period of time are a key sign you've found a company enjoying a strong competitive position.

7. Assets with greater value than the company's market cap

Investors often view companies owning a collection of disparate assets to be worth something less than the sum of their individual values. A common misconception is that the businesses or assets that aren't part of the "core" operation are somehow less valuable.

Look for companies with businesses in more than one industry... business segments generating different financial returns... valuable real estate holdings... and/or excess assets, such as a large cash position. Oftentimes, you'll discover that the sum of these individual assets exceeds the company's current market cap.

8. Spinoffs

Larger companies with diversified operations sometimes "spin off" a smaller division or subsidiary into a separate public company. These spinoffs often run better as independent companies and sometimes become great investments on their own. Buying Altria (MO) before it spun off Philip Morris (PM) worked out well for Extreme Value readers. So did owning ADP Dealer Services before it spun off CDK Global (CDK).

Be wary of spinoffs saddled with huge debt by the parent company – something we find to be a deal-breaker more often than not.

9. Emerging paradigms

Companies creating tectonic shifts in a particular industry have the potential to become life-changing investment opportunities. Apple's iPhone helped make the mobile communications industry what it is today. And Netflix (NFLX) obliterated the movie-rental business that Blockbuster dominated for years.

New ways of doing business come and go all the time. The challenge is recognizing which companies possess the right business model and management acumen to capitalize on the market opportunity.

10. Customer loyalty

My colleague Doc Eifrig wrote about this in the April 7 DailyWealth. Customer loyalty ensures continuous demand, insulates the business from upstart competitors, and is a leading indicator of financial performance.

Keep in mind, these 10 investing setups aren't mutually exclusive. In fact, the greatest opportunities tend to be businesses demonstrating multiple themes. For instance, Apple wasn't just a great operating-leverage story a decade ago. The company also experienced tremendous customer loyalty and investors generally underappreciated the iPhone growth story.

Stay on the lookout for these 10 successful investing setups, and pay particular attention to any business intersecting multiple themes.

Good investing,

Mike Barrett

Further Reading:

Last month, Mike discussed why estimating how many piano tuners are in Chicago can greatly improve your investment results. Read more here: To Become an Elite Investor, You Must Master This Skill.

Investing is also about knowing which types of companies to avoid. "Not losing money is more important than making it," Dan Ferris says. Get the story here: The Five Types of Stocks You Must Avoid.

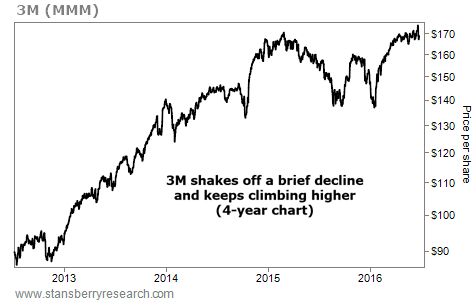

Market NotesTHIS BULL MARKET IS BACK IN FULL SWING Today's chart shows the bull market in manufacturing has resumed...

Regular DailyWealth readers know we routinely track several businesses that tell us what's going on in the U.S. economy. Over the years, we've written about how credit-card companies, ski-resort operators, and pool-supply firms can act as reliable gauges for economic stability.

The manufacturing industry is another example. Consider $100 billion manufacturing conglomerate 3M (MMM). The company makes everything from aircraft-control systems to Post-it notes and Scotch tape. 3M did $30 billion in sales last year and has nearly 90,000 employees. When the U.S. economy is chugging along, shares of 3M benefit.

You can see that 3M is in the middle of a multiyear bull market. The stock slid roughly 20% from March 2015 through this past January. But it has since resumed its uptrend, recently touching a new all-time high. Shares are up about 300% from their 2009 lows. It's another good sign for the U.S. economy.

|

Recent Articles

|