| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: The markets will be closed on Independence Day, so we won't publish DailyWealth on Monday. We'll pick up with our normal schedule on Tuesday. Enjoy the holiday.

The Typical Businessman's Apartment in Beijing Costs US$1 MillionBy

Friday, July 1, 2016

"Song Gao is a rock star," our host Brendan Ahern of KraneShares told us as we entered Song's office in Beijing.

"Few people understand China as well as Song."

Brendan wasn't kidding... Song has his PhD in economics. He studied (and taught) in the U.S. before returning to China. So he understands the U.S., too, which means he can effectively compare and contrast the two global powers.

The great part is, Song can deliver insights on the most complicated issues with a simple story and a smile.

Today, Song is the co-CEO of PRC Macro, an economic consulting company in Beijing.

"We call it like we see it," it says on PRC Macro's website. And Song does exactly that – even when it might differ from the Communist Party's message.

"I thought China was communist..." my wife said to me on the phone. "How can he do that?"

In short, forget what you know about communism. Today, Beijing – China's capital – feels as capitalist as anywhere...

It has been four decades since China started its break from traditional communism. The system has changed to such a degree that it is unrecognizable from where it started. People here in Beijing are free to seek out higher-paying jobs, earn what they want, and spend it how they want.

The only noticeable difference as a visitor here is some Internet censorship. (You can't go to Google, Facebook, or YouTube, and you can't get news from Bloomberg or Reuters. China has its own versions of each of these.)

Song actually does some incredible work on understanding the "man on the street" in China...

His company does a quarterly survey of consumers, for example. Interestingly, his work is not controlled in any way by the Chinese government – these are HIS survey results... that HE publishes.

The PRC Macro surveys give some amazing insights into the typical life of citizens in the big cities. Let me share a few interesting survey highlights...

The most interesting number Song shared wasn't in the surveys, though... I asked him about the cost of living. "What is the price of a typical apartment for a businessman here in Beijing?" I said.

"A typical 1,000-square-foot apartment for a typical businessman would cost about US$1 million," Song told me.

Wow. A million dollars for a 1,000-square-foot place in Beijing...

Song knows that is A LOT of money. He knows the American perspective on this. He has lived in the U.S., so he knows what money can buy in the States. But that doesn't change the fact that a decent apartment in Beijing will cost you a million dollars today.

It sounds like the making of a property bubble at first... But it could be more like New York or San Francisco, where there's more demand than supply in the city center.

"The Chinese people have a strong attachment to property," he explained. "You would be surprised – there isn't nearly as much debt as you might think. First-time homebuyers have to put 30% down as a down payment, for example. And many put much more down."

Getting back to the big picture... Stop putting the words "China" and "communist" together in your head... It was shocking for me to discover, but Beijing feels as capitalist as any city in the world...

This is not your father's China... If that's what you think China looks like, change your thinking, right now...

Good investing,

Further Reading:

"Take your opinions or mental images of Beijing, and throw them out the window," Steve writes. Beijing is a lot more futuristic than you can possibly imagine... Read more here: Why China Is NOT an Emerging Market.

Right now, a certain group of Chinese stocks is offering high dividend yields... and is trading at super-cheap valuations. This opportunity is almost impossible to find... But Steve has nailed down the perfect, safe investment. Learn how to profit from this extreme right here.

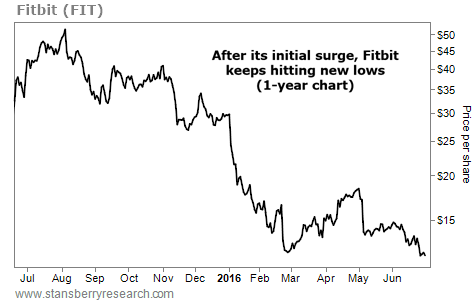

Market NotesTHIS TRENDY STOCK HAS FALLEN OFF A CLIFF Today's chart proves, yet again, why it rarely pays to own the latest fad...

We're looking at fitness stock Fitbit (FIT). The company's wearable trackers help users monitor their daily steps, heart rate, and sleep patterns.

A little more than a year ago, Fitbit went public around $30 a share. Investors bought into the hype, calling it the next big thing. Shares soared to more than $51 in early August – a gain of nearly 70% in less than two months.

Since then, Fitbit shares have been stuck in a steady downtrend. The stock has plummeted more than 75% from its August high, hitting another new low this week. It's yet another reason why investors should avoid the most recent trends and stick to what works...

|

Recent Articles

|