| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Only Advantage You'll Ever Get in the Financial MarketsBy

Friday, September 30, 2016

There's one simple way you can make a fortune in the financial markets.

It's simple, but it's not easy...

First, you must understand the three advantages the market has over you. Stop trying to beat it at these things. You can't. You'll waste your time and your money...

The informational advantage: You need good information to succeed in the financial markets, but you'll never have more information about an industry or a public company than all the other investors in the market combined.

The analytical advantage: Financial markets are populated by armies of overeducated, workaholic geniuses who analyze every aspect of every stock, bond, and index while calculating square roots and standard deviations in their heads.

Again, you need good analytical skills to succeed in the financial markets, but you're not going to out-analyze the market.

The timing advantage: No matter what anyone tells you, you can't time the market. There are millions of people making individual market decisions every day. It's impossible to predict what they will do with any consistent accuracy.

Forget about the advantages you can't get. Instead, focus on the one that's readily available to all investors – individual and professional alike: the behavioral advantage.

To make plenty of money in stocks, you must behave better than the vast herd of investors.

Research firm Dalbar publishes an annual study on investor behavior called the Quantitative Analysis of Investor Behavior ("QAIB"). Every year since 1994, the QAIB has compared stock market returns over the previous decades with returns earned by real investors. The result is always the same: The market beats the investor.

For the 30 years ended December 31, 2015, the S&P 500 returned 10.4% per year, on average. Equity mutual fund investors earned an average return of just 3.7% per year.

Those investors didn't have as much information as the market, it's unlikely they were better-than-average analysts, and they definitely failed to time the market. They bought at the top and sold at the bottom (the primary behavior responsible for their awful returns).

Behavior made all the difference, and it was a huge difference... The S&P 500 turned every $10,000 invested into about $192,000 over 30 years. The average investor turned that $10,000 into just $29,000.

A single behavior – refusing to sell at market bottoms – would have multiplied profits nearly tenfold.

Investment legend Warren Buffett has often said that to succeed as a stock investor, you need to "be fearful when others are greedy and greedy when others are fearful." He means you need to buy at or near market bottoms and sell, or at least not buy, at or near market tops.

This is essentially the behavioral advantage. But I've thought about Buffett's quote a lot over the years, and his paradigm of waxing and waning greed and fear doesn't work for me. I've observed something different...

Financial markets don't really oscillate between greed and fear... Fear is the dominant emotional impetus in the market at all times. It's just magnified at big market tops and bottoms. People are afraid of not doing what everyone else is doing, at the top, the bottom, and every day in between.

Acquiring the behavioral advantage is simple (but again, not easy). Don't be afraid to move in a different direction than the herd.

You'll never banish fear entirely. Your biology won't let that happen. So maybe, like an old self-help book title said, you must learn to "feel the fear and do it anyway."

Good investing,

Further Reading:

If you really want to go against the crowd, you need to know about Steve's "cocktail-party indicator." As he explains, this indicator is nearly infallible... and will save you headaches in the market. Read more here.

Longtime readers know Steve's criteria for a "perfect" investment is something that is cheap, hated, and in an uptrend. In February, he laid out an investment that fit the bill. Readers who followed Steve's advice enjoyed gains of 22% over the next three-and-a-half months. Get the full story here.

Market NotesLIKE IT OR NOT, THIS MAJOR TREND CONTINUES Today we revisit one of the biggest trends in the market over the past few years – "offense" contractors...

Over the years, we've noted that the U.S. is involved in so many foreign wars that defense contractors should be called "offense" contractors. Many folks warned against investing in this industry due to an expected reduction in government spending. But today's chart shows this hasn't been the case at all...

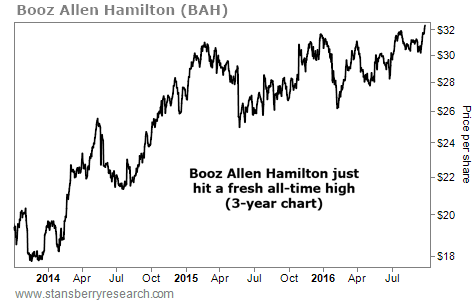

Take a look at the share-price action in industry leader Booz Allen Hamilton (BAH). You may remember Booz Allen as the former employer of NSA whistleblower Edward Snowden. This business is a leader in cybersecurity and surveillance contracting. And it relies almost entirely on government spending.

As you can see, shares have nearly doubled over the past three years – reaching a new all-time high this week. Just yesterday, Congress avoided a government shutdown and approved another new short-term spending bill. Whether you like it or not, the trend in "offense" contractors isn't likely to end anytime soon...

|

Recent Articles

|