| Home | About Us | Resources | Archive | Free Reports | Market Window |

Are You an Amateur or a Pro?By

Friday, June 16, 2017

Did you panic? Were you afraid?

Last month, on Wednesday, May 17, stocks got beaten up. After starting the week at new highs (around 2,400 on the S&P 500 Index), stocks fell nearly 2% – their worst one-day fall this year.

Anytime investors are reminded that stocks can go down as well as up in value, our mailbag "lights up." Subscribers suddenly want to have constant contact with us. They need reassurance.

Friends... If last month's market action bothered you in any way, there's a huge problem with your portfolio.

Think honestly. When you first saw how the market was going to open (way down) that day, what was your first reaction? Or, if you didn't see the open, what happened that night when you first saw the news? Or during the day when stocks just kept going down, lower and lower?

Be honest with yourself. If you felt even a twinge of fear, you've got a big problem. Let me explain why...

May 17 saw about three weeks' worth of market gains wiped out, temporarily. It was a tiny, 2% move lower. It wasn't a bump in the road. It was barely a ripple on the calmest lake the equity markets have ever seen.

Since 2015, stocks have been ripping higher, propelled by "rocket fuel" – central banks, sovereign wealth funds, corporate buybacks, and value-ignoring index-fund investors. There's hardly been a down day in nearly two years. This incredible rally has created record levels of investor complacency – aka, investor stupidity.

It has also, almost surely, lulled many of our subscribers into portfolio-allocation decisions that are far too aggressive.

It's like this... On the golf course, virtually every amateur player overestimates how far he can hit the golf ball, usually by 20% or more.

Why? Because our best-ever shot becomes our expected outcome.

As we're sitting there on the tee box, we're thinking, "I crushed the ball the last time I played this hole. I'm sure I can do it again." Instead of making a conservative swing on the ball – a swing we can hit well nine out of 10 times – we end up taking the big cut... the move that almost never works.

Pro golfers don't make this mistake. They study the distance of every club in the bag, based on their most repeatable swing. They know their distances down to the precise yard. And they don't try to make swings they can't repeat virtually every single time.

Amateur investors make the same kind of mistake as amateur golfers.

They vastly overestimate the expected outcome of their investments. Think about this the next time you buy a stock. Write down what you're expecting to make (annualized) from the investment. Now go and look at what your actual annualized returns have been from similar investments.

The odds are you're overestimating your expected returns by at least 100% – meaning, you're expecting to make twice as much as history suggests you will.

You're probably doing the same thing right now in your portfolio: you're holding positions because you're sure they're going to soar.

Meanwhile, it's unlikely stocks will produce the sort of returns you're expecting...

With stocks trading at near-record valuations, with GDP growth below 3%, with consumer debt crashing, with extremely low interest rates, and with weak and declining commodity prices, it's unlikely stocks will produce double-digit annualized returns in the time frame you're planning for. Very unlikely. Virtually impossible.

But every time you buy a stock, I'm sure you expect to make more than 20% over the next year. Or maybe even in the next quarter.

That's because, like an amateur golfer, you're thinking of that great "shot" you hit back in 2015 – that stock you bought two years ago that's soared with the market.

But that's not what's going to happen this time.

Last month's one-day fall was a warning from the stock market "volcano."

It was just a minor rumble. A tiny taste of what will happen when we get hit with another bear market and the major indexes fall more than 20%.

If you were worried last month, you'll be crushed – wiped out – by a bear market.

I know... you say you will follow your trailing stops. Or, you say you will just hold on "no matter what." But almost everyone who sets out to be a "buy and hold" investor ends up becoming a "buy and fold" investor. Just as you overestimate your expected returns, you're also overestimating your risk tolerance.

If you'd asked investors back in 2009 about their risk tolerance, they all would have said "none." They would have told you, "I'm tired of stocks. I only want safe investments. Just give me something that's safe."

Today, you hear exactly the opposite. At conferences, I'm constantly seeing subscribers telling people, "I'm an accredited investor. I can handle the risks."

But they can't. Not really. Almost no one can.

Here's the best way to think about the risks you're taking...

If you're 100% invested (long stocks) it's only a matter of time before you suffer a 50% drawdown – at a minimum. Warren Buffett, the world's best long-only investor, has seen the value of his equity holdings drop by 50% three times in his career. And it has happened twice since 1999.

You probably aren't as good of an investor as Buffett. It's likely that your results won't be as good as his have been... which means that if you are a long-only investor, you will (not might) suffer more than a 50% decline in the value of your equity portfolio.

If you're using trailing stops, you can greatly limit this volatility.

And that's why I endorse TradeStops so strongly. (To be fair, I'm also a part owner of the company. But I invested in it because I share in Richard Smith's mission... To give individual investors the best possible tools to help them become more successful investors.)

In fact, if you merely use a trailing stop loss and reasonable position sizes, I can almost guarantee that your investment results will become dramatically better.

And there's another, even better way to limit the volatility of your portfolio.

Consider "hedging" your portfolio by adding small positions in investments that are designed to go up when the stock market goes down – like short sells and gold stocks. You should also consider a big allocation to short-term corporate bonds and mortgages. Or if you don't understand these kinds of investments, then simply hold cash.

In our Portfolio Solutions newsletters, The Total Portfolio is a diversified and hedged portfolio...

At the time, on May 17, we had about 25% of the portfolio in corporate bonds. Some of this allocation (10%) was directly in carefully selected high-yield bonds. But the majority of this allocation to fixed income was via high-quality insurance stocks, which are really just big piles of bonds (plus underwriting profits).

This is the kind of firm foundation we want in our portfolio. And to further reduce volatility, we had another 20% of the portfolio long super-safe mortgages and cash-like, very-short-term loans to investment-grade corporations.

Thus, about 45% of our portfolio was in fixed income and cash. It was like driving with a parachute tied to our car. It probably limited our top speed... But it kept us from crashing in the corners. That doesn't mean we can't still produce very good results, though. In our most recent issue of The Total Portfolio, we reported about a 21% annualized rate of return.

But the real magic in what we're doing comes from the two things that you probably won't do. Ever.

When stocks fell that day, we had 10% of the portfolio allocated to short-sell positions and gold stocks. This strategy doesn't reduce volatility, as these positions are enormously volatile. But they're also negatively correlated. So, when stocks go down (like they did on May 17), this part of the portfolio goes straight up.

That day, the S&P 500 dropped 1.8%. Our Total Portfolio was down, too... But only by 1.3%.

That probably doesn't seem like a big difference to you. But proportionally, it's a huge difference. Our portfolio's decline was more than a quarter less than the S&P 500's. What if the market's move down had been 10 times worse, like a correction or even a real bear market?...

I'm certain you'd feel a lot better looking at a 13% portfolio decline than an 18% portfolio decline. And if you can get this reduction in risk without a corresponding decline in performance, why wouldn't you hedge your portfolio?

Again, if you looked carefully at our Total Portfolio last month, you'd have found a very conservative allocation mix, with almost 50% of the portfolio in very stable investments like mortgages, corporate bonds, or short-term credit facilities, and with an additional 10% of the portfolio completely hedged (short positions, gold stocks). This allocation allowed us to reduce our downside by almost 30% on the market's worst day of the year so far.

If you were nervous on May 17... change your allocation immediately. Act like a pro. Go for the "shot" you know you can hit. Stick with an allocation that lets you sleep at night and that fills you with confidence on bad days in the market.

Good investing,

Porter Stansberry

Further Reading:

"Investors are never going to beat the market until they learn the right way to think about investing," Richard Smith writes. Investors often fail to limit their losses... But they also fail to let their winners ride. Learn the easiest way to avoid these mistakes right here: This Simple Investing Tool Can Help You Beat the Market.

"I never dreamed that a classic investing disaster could have been instrumental in getting a president elected," Richard says. One man's devastating loss illustrates the crucial importance of position sizing. It was an event with surprising consequences... And we can learn from it today. Read more here: How One Bad Trade Got Trump Elected.

Market NotesHEALTH CARE'S BIG TREND BOOSTS THIS STOCK Today's chart highlights a health care powerhouse...

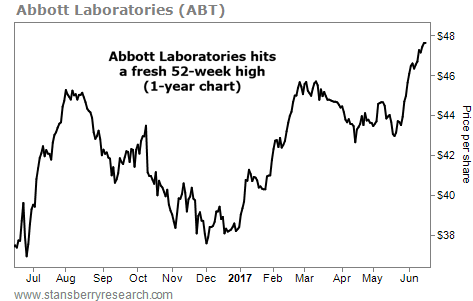

Recently, we reminded readers about our colleague Dave Eifrig's bullish call on health care stocks, here and here. For years now, Dave has noted how aging Baby Boomers are driving more health care consumption. Yet another winner from this big trend is Abbott Laboratories (ABT)...

Abbott is a leader in diagnostics, medical devices, nutrition, and generic pharmaceuticals. Its testing and diagnostic instruments are used worldwide in hospitals, labs, and doctor's offices. Abbott owns many popular consumer brands, including Pedialyte (hydration solution) and Ensure (nutrition shakes). Plus, the company has paid a dividend since 1924 and has increased it for 45 consecutive years. That's a claim few companies can make...

As you can see, Abbott's shares are up nearly 25% this year... and recently hit a fresh 52-week high. With "one of the world's greatest tailwinds" at its back – an aging population – Abbott's share price will likely continue higher...

|

Recent Articles

|