| Home | About Us | Resources | Archive | Free Reports | Market Window |

Today's Announcement Could Change the Investing World ForeverBy

Tuesday, June 20, 2017

Today is one of the most important days in the history of investing...

This single day could force big investors to make huge changes to their investments. And it's just the beginning...

This afternoon, MSCI – the leader in global stock market indexes – will announce the results of its annual meeting. MSCI holds this meeting to decide on any changes to its index weightings.

Normally, nobody cares... But this time around, the changes should be historic. And they will likely affect you...

I predict – for the first time in history – MSCI will finally include Chinese A-shares in its global indexes.

This is a big change. And it likely affects you, even if you don't realize it. You are about to start owning local Chinese stocks in your pension fund – for the first time ever.

You see, right now, roughly zero percent of American retirement assets are invested in local Chinese A-shares. But that will all change when MSCI includes local Chinese stocks in its indexes.

Here's what I mean...

Right now, 94% of U.S. pension funds that are invested in global stocks are benchmarked to MSCI's indexes. So if you're a teacher, a firefighter, or anyone else with a decent pension fund, you will unknowingly start owning local Chinese stocks for the first time... very soon.

Today's announcement from MSCI could trigger a massive change in global finance.

But it won't happen overnight.

Today's announcement is the first step of a massive shift into Chinese stocks.

It's the first roll of the small snowball down the hill.

To me, this decision by MSCI is a "no brainer"...

China is the world's second-largest economy and second-largest stock market. Yet China's local stock market is completely left out of MSCI's emerging market index.

This is a financial wrong that must be righted.

It makes no sense for the stock market in the world's largest emerging market to have a zero-percent weighting in the world's biggest emerging market index!

Of course, MSCI had its reasons for not including China. It has been difficult historically for investors to move money in and out of China. But that has gotten easier in recent years.

In short, MSCI put up several roadblocks for inclusion over the past few years... And China has checked all of the boxes. It has made it past the roadblocks.

That's why I expect MSCI to announce a plan to include Chinese stocks this afternoon, shortly after 4:30 p.m. Eastern time.

Normally, decisions about changes in indexes are boring and irrelevant. But today's announcement is different... Today's announcement – and the changes it causes – will ultimately have a dramatic effect on your money as U.S. investors start piling into Chinese stocks.

My advice all along was to get your money ahead of this decision. I said to buy China before the MSCI announcement... before the rest of the world wakes up to what I see.

The day of reckoning is here. And my advice remains the same: Own Chinese stocks.

Good investing,

Steve

Further Reading:

"I hope you're not solely invested here at home," Steve says. We're seeing an extraordinary situation in the markets today. The last time this happened, emerging markets went on to soar 400% over the next few years... Learn more here: Why You Need to Move Money OUT of the U.S. Today.

"If I wanted to film a movie that's set in the future, I would come to China to do it," Steve writes. China is the world's second-largest economy – and it shows. Read more about Steve's recent eye-opening trip to Beijing right here.

Market NotesA CHECK-UP ON THE U.S. ECONOMY Today's chart shows the continued uptrend in a gauge of the American economy...

One of the simplest ways to measure the state of the economy is to look at consumer spending. When people are confident about the economy and the stability of their jobs, they spend more money on things like electronics, furniture, and clothes. When confidence is low, people hold on to their cash instead.

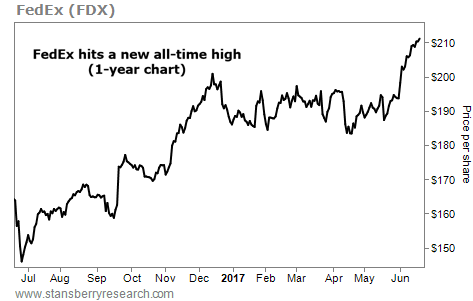

To get a feel for consumer spending, we can look at shares of shipping giant FedEx (FDX). Americans are shopping increasingly through e-commerce sites like Amazon (AMZN), rather than at brick-and-mortar locations. But to deliver those orders, you need a shipping company like FedEx.

Last quarter, the company announced record-breaking peaks in both shipping volume and service quality. As you can see below, FedEx's shares are up around 30% over the past year... And they recently hit a new all-time high. This consumer-spending gauge says the U.S. economy is still going strong...

|

Recent Articles

|