| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Steve's note: It's clear that bitcoin stirs up controversy and skepticism. I'm cautious on cryptocurrencies myself. But it's a fascinating new idea, worth learning about. Last week, we shared a bitcoin series from my colleague Tama Churchouse. Today, we're sharing another essay from his publisher Kim Iskyan about how bitcoin triggers our hidden biases – and how fighting those biases can make you a better investor...

Is This Common Investor Bias Costing You a Fortune Today?By

Wednesday, October 25, 2017

You don't have to look far to find financial luminaries and talking heads declaring the death of bitcoin...

In just the past few months:

These folks all have one thing in common. They're victims of the "default bias"... Have you ever been overwhelmed by the choices on a restaurant's wine menu and just decided on the house wine? Or, when you buy the latest mobile phone, do you just accept the factory default settings and not even bother changing the ringtone?

Most people are happy to stick with the standard options. Even when we have several choices, we go with the default choice because it's easier and more comfortable.

For example, scientists have looked at people's attitudes toward donating their organs when they die. In countries where you have to opt in to be a donor, only about 15% of people choose to donate their organs. But in countries where donating organs is the default option, more than 90% of people opt to donate.

If no default or standard option exists, we tend to use the past as our "default setting." Most people like to stick with what they know and are anxious about taking on new risks, even if the change would be good for them.

Default bias is the offspring of two other biases: status-quo bias and loss aversion. Keeping things the same (status quo) is convenient... And we believe the pain of losing is greater than the joy that comes from winning (loss aversion).

Put these together, and our brains often tell us it's just easier to keep things the same and avoid any potential pain that might come from changing things.

For investors, this default bias can stop us from making changes to our portfolio or strategy. We tend to cling to the way things are, even if it's not the best thing for us.

This even happened with one of history's most game-changing technologies...

In the early 1990s, the Internet was just starting to go mainstream. And many otherwise smart folks were convinced it was just a fad.

Here's a quote from U.S. astronomer Clifford Stroll in 1995:

Even the inventor of Ethernet, Robert Metcalfe, didn't believe in the Internet. "I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse," he said. And telecommunications expert Waring Partridge had this to say: "Most things that succeed don't require retraining 250 million people."

These people fell for the default bias. They believed in what they knew and were anxious about making big changes.

Plenty of investors fell for it, too. And they missed out on big gains as the Nasdaq – which is home to many tech stocks – increased 400% from 1995 to 2000.

We're seeing the exact same thing happen with bitcoin and cryptocurrencies today... It's like a replay of the status-quo bias that led people to dismiss the Internet.

Anyone who claims bitcoin isn't "real" or it will "close" (as Dimon did) doesn't understand the cryptocurrency at all...

As my colleague Tama Churchouse has written before, bitcoin is money. It can be moved around (far more easily than traditional currencies). It can buy goods and services. And it has scarcity... Only 21 million bitcoins will ever be mined. And more than 16.5 million have already been mined.

As for the concern that bitcoin is purely "digital," it's worth remembering that more than 90% of all money that exists today around the world is not physical (i.e., not notes or coins).

Lastly, bitcoin can't be "closed." It's not an overleveraged credit derivative fund. It's a highly secure distributed blockchain running on a global network of computers.

Bitcoin is just a cryptographically secure medium of exchanging value.

In short, every now and then something truly new and different comes along. And if you're willing to go against your default bias, you could make a fortune.

Good investing,

Kim Iskyan

Further Reading:

Dave Eifrig explained another common investor bias – "anchoring bias" – to DailyWealth readers in July. Get the full story here: My Best Advice: Buy High (and Sell Higher).

"For many people, there's no place like home," Kim Iskyan writes. "It's familiar and comfortable. But for your portfolio, staying at home means taking on a lot more risk than you might realize." Learn more about another common investor pitfall here: Make Sure Your Portfolio Isn't Guilty of This Common Problem.

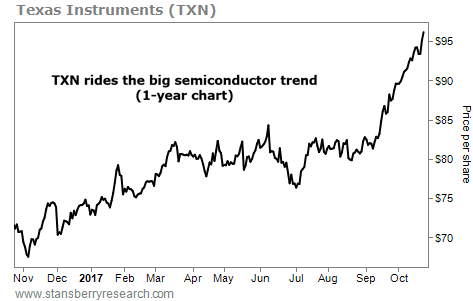

Market NotesA HUGE SECULAR TREND YOU MIGHT NOT HAVE NOTICED Today's chart highlights another winner in the booming semiconductor industry...

Regular readers know we're always looking for big secular trends to invest in. Due to the increasing reliance on personal computers and cellphones, right now is a good time to be a semiconductor business. These companies produce the little devices that power most of the electronics we use today.

Texas Instruments (TXN) is an industry leader. It earns big profits – nearly $4 billion over the past year – by selling computer chips and processors. And business is booming: Last quarter, Texas Instruments' sales jumped 13% versus the same period last year. The company earned nearly $800 million in cash profits in the second quarter alone.

As you can see in the chart below, its shares are soaring. They're up nearly 35% over the past year... and they just hit a new all-time high. As long as we continue to rely on chips and processors to power our devices, TXN will continue to thrive...

|

Recent Articles

|