| Home | About Us | Resources | Archive | Free Reports | Market Window |

Here's Why I Hope You Miss the Boat...By

Friday, October 27, 2017

It's going to happen... And it's going to be frustrating...

You're going to miss the boat.

At least, I hope you do...

Over the past two months, the benchmark S&P 500 Index is up 4.7%... The tech-heavy Nasdaq Composite Index is up 4.8%... And the small-cap Russell 2000 Index is up 8.4%.

My colleague Steve Sjuggerud says this is the beginning of the "Melt Up" – the last stretch in a bull market when stocks skyrocket.

We can't know whether or not a Melt Up will play out as it did in the late 1990s. But based on the recent price action, it's looking more and more likely that Steve will be right. So today, we're going to think about how you can prepare.

Now, when I say, "I hope you miss the boat," I don't mean the Melt Up as a whole. (I am here to help you make money, after all.)

I'm talking about specific stocks...

Before I explain what I mean by that, though, let's talk about volatility...

One of the funny things about bull markets is that they like to take as few people along for the ride as possible. They'll throw you off and trample you, given the chance.

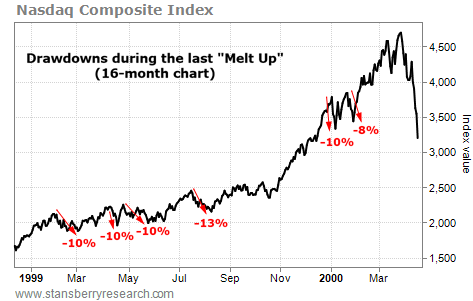

Just look at a chart of the Nasdaq from late 1998 through mid-April 2000. During the final 15 months of the last Melt Up, the Nasdaq soared 146%... But it also dropped 8% or more, six times...

By contrast, over the past 15 months, the biggest drop in the Nasdaq was 5.5%, which came leading up to the presidential election last year. Since then, volatility has been almost nonexistent. And I'll go out on a limb and say that most folks with money in stocks today are not prepared for the sort of volatility we saw during the last Melt Up. Not mentally or strategically...

To prepare mentally, you may want to print out that chart and tape it to your computer monitor.

To prepare strategically, you need to get comfortable with missing the boat.

Here's what I mean...

During a Melt Up, you won't know when a sharp decline is coming. The chart above shows the Nasdaq... which is an average of thousands of stocks. When the index fell 10%, a lot of individual stocks fell far more.

If you happened to buy a stock at the wrong time, you could have stopped out for a 15%-25% loss in a matter of days... then watched as it turned around and doubled, tripled, or more. You could have missed the boat.

I'd like you to take away two important points here...

First, during a Melt Up, you won't know which decline will be the start of a bear market... So you need to set stop losses on all of your positions, and stick to them. It's one of the best ways to protect your wealth.

You may miss the biggest gains on some, or even a lot of stocks. But that's OK. As long as you follow this next piece of advice, you should still do extremely well...

You need to be picky about your entry points. If a stock looks great – but has just popped higher – wait for a pullback before you buy. By waiting for a pullback, you'll greatly reduce your chances of stopping out ahead of the next big move.

If you're picky about your entry points, you'll still miss the boat sometimes. The stocks you want to own won't always pull back to a convenient entry point. But at least this way, if you do miss the boat, you won't take a big loss beforehand.

In my DailyWealth Trader newsletter, we apply this idea by recommending stocks with buy-up-to prices – sometimes below the current share price. We can't know if they will come back down to our buy-up-to prices... We may miss one here and there.

If one gets away from us, we'll keep an eye on the stock. We may see another good entry point. But we're ready and willing to move on... to look for other opportunities.

We may be in the early stages of a spectacular Melt Up. If you're prepared both mentally and strategically, you should be able to make a lot of money. If you're not, it could be a major source of frustration.

One of the best ways to prepare is by being disciplined with your purchases. And that means sometimes, you'll miss the boat.

Good trading,

Ben Morris

Further Reading:

"When this market goes down – and it will – that move will scare people," Steve says. "But you will know what's going on." To profit from the Melt Up in stocks, you must be prepared for short-term dips. You can even use them as opportunities... Learn more here.

"Stop losses are designed to limit risk and to remove emotions from your trading decisions," Ben writes. As he explained today, sticking to a system like this is one of the best ways to protect your wealth. Read his rundown on how to choose a stop loss right here.

Market NotesANOTHER 'DIGITAL UTILITY' PROVES A RELIABLE WINNER Today, we highlight a software company that's crucial to how we live and work...

Regular readers know we're bullish on utility companies – but some established technology companies can play a similar role. Our colleague Dave Eifrig calls them "digital utilities." Just like you can't turn the lights on without your electric company, you can hardly use a computer without these companies' products. And because these businesses are less regulated than traditional utilities, they can grow their profits much faster.

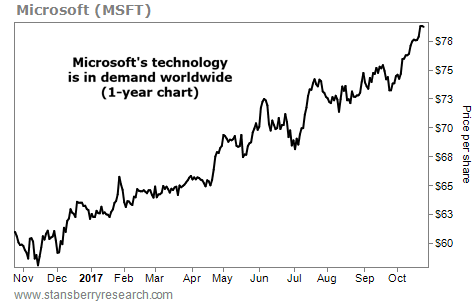

Software behemoth Microsoft (MSFT) is a perfect example. With its popular Windows operating system and Microsoft Office suite of productivity tools, this company dominates our tech-driven daily lives. More than 500 million devices run its latest Windows 10 software today... And more than 100 million people use its subscription-based Office 365 each month. It's no surprise that Microsoft brought in $85.3 billion in revenue last year.

As you can see in the chart below, the stock is up more than 30% in the past year. Shares have hit record highs in recent sessions. Keep your eye on digital-utility stocks like this – they can make reliable winners...

|

Recent Articles

|