| Home | About Us | Resources | Archive | Free Reports | Market Window |

New Home Sales 'Soaring' and 'Surging,' With More Gains to ComeBy

Tuesday, October 31, 2017

"U.S. New Home Sales Soar to Highest Level in a Decade," USA Today reported last week.

"New Homes Sales Growth Surges to 25-Year High," the Wall Street Journal said.

So which is it? Are new-home sales the highest they've been in a decade... or in 25 years?

It turns out, the answer is BOTH...

The number of new homes sold last month reached 667,000 – the highest level since October 2007, a decade ago, during the last housing boom.

Looked at another way, though, new-home sales jumped by 18.9% – the highest monthly sales growth in 25 years.

Why did so many new homes sell last month? The hurricanes likely played a part.

But to me, the big factor in the housing market is the low supply of existing homes for sale.

It's Economics 101 – when you have no supply and a ton of demand, prices go higher.

Specifically, housing supply is measured in months – that is, how long it will take for the existing inventory of houses to sell at the existing rate of sales. Right now, we're sitting at 4.2 months of supply.

It is rarely lower than this... In fact, over the last 20 years, it was significantly lower only once – in early 2005. That was during the final years of the last great housing boom in the U.S... And house prices REALLY soared after that.

I expect the low supply today will create a similar effect – dramatically higher home prices.

The average sale price of new homes hit an all-time record last month, at $385,200. The median price for new homes was $319,700.

Keep in mind, new homes are only a fraction of the housing market. And the average home price is always higher than the median home price... For comparison, the median price of existing homes sold last month was $246,800.

But with scarce supply, that means we have plenty of upside ahead.

Higher house prices have been part of my big theme for the last eight years... Since then, I have said:

The "Melt Up" is arriving in stocks, driving stock prices to new heights as the bull market enters its final phase. And now, the boom time is arriving in the housing market, too... I believe we still have plenty of upside potential ahead... You haven't missed it yet in housing.

Good investing,

Steve

Further Reading:

"Housing could be a good alternative when stocks start to falter," Steve says. According to one study, adding real estate to your portfolio is a great way to get the highest gains for the lowest risk. Learn more here: Think Stocks Are the Best Long-Term Investment? Think Again.

"The real estate boom is nowhere near done yet," Steve writes. Home supply is low... And that means one group of stocks could soar as the trend continues. Read more here: The Easiest Way to Profit in the Real Estate Boom.

Market NotesTHE RETAIL 'OLD GUARD' IS IN TROUBLE Today's chart highlights more problems in retail...

Regular readers know that people aren't shopping the way they used to... Mall traffic is steadily declining as online shopping grows. We've seen this big trend at work with companies like mall operator Tanger Factory Outlet Centers (SKT), jewelry store Signet Jewelers (SIG), and even auto-parts retailer Advance Auto Parts (AAP). Today, we see it in one of the "old guard"...

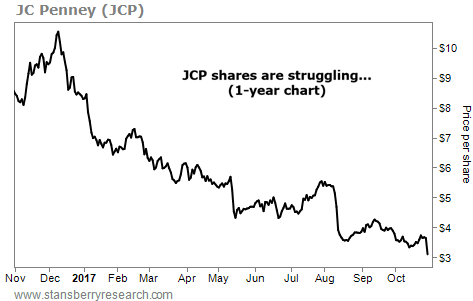

JC Penney (JCP) is one of the oldest department stores in the U.S. It has been in business for more than a century, with about 875 stores across the U.S. and Puerto Rico. But its business is dwindling... Earlier this year, JC Penney announced plans to close 138 stores. And last week, it reported a big quarterly loss and a reduced sales forecast for the rest of the year.

On Friday, the stock tumbled nearly 15% on the news. Shares are down more than 70% from their December peak and are now trading at a new 52-week low. It's looking less and less likely that JC Penney will survive another century in retail...

|

Recent Articles

|