| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

The Weekend Edition is pulled from the daily Stansberry Digest. The Digest comes free with a subscription to any of our premium products.

Why Millions of Americans Feel They Have Nothing to LoseBy

Saturday, November 4, 2017

Whether it's violent protests in major cities across the country... soaring rates of drug abuse and suicide... or even the recent national anthem controversy in the NFL, it's clear...

Something is wrong in America.

If you're like us, you can't open a newspaper or turn on the nightly news without feeling as though the fabric of civil society is being torn apart.

But recently, Porter introduced a controversial idea...

What if America's political and social upheaval wasn't quite what it seemed? What if these problems were a symptom of something much bigger... and much more important? As Porter explained last Saturday...

Yes, vast amounts of bad mortgage debt were wiped out. But American consumers – to say nothing of corporations or the government itself – never stopped borrowing. Our economy never really deleveraged.

In essence, we simply replaced mortgage debt with vast amounts of new consumer debt. Americans ran up their credit cards, bought fancy cars they couldn't really afford, and borrowed insane amounts of money for college degrees of questionable value. And Americans now hold more total debt than ever before in history.

Even during the peak of the housing bubble – when lenders issued lots of subprime mortgages without even checking a borrower's income – most mortgages were well collateralized. Even then, most people had the income required to pay the loan.

But that is not the case today. Most of this consumer debt has been concentrated in the poorest segments of our society. More from last Saturday's issue...

In other words, a huge number of Americans have borrowed more money than they can ever dream of repaying... They have little of value to show for it. They have no way out. And they have no hope that things will get better. So what you're seeing on the news is just the tip of the iceberg...

Tens of millions of angry Americans increasingly feel they have nothing to lose.

Worst of all, this is happening despite some of the lowest interest rates in history. Debt-service costs have never been cheaper.

But interest rates are already moving higher. How many more Americans will join the ranks of their fellow indebted citizens as these massive debts become more and more costly? What happens then?

Sooner or later, the U.S. government will have no choice but to appease these folks. They will wipe out these debts and redistribute trillions of dollars in the process. That's what Porter was describing when he referred to the "jubilee" in America.

Again, there's no denying this problem or the likely "solution." But Porter left one question unanswered... Why on Earth did so many people borrow so much money they have no hope of ever repaying?

You might assume it stems from a lack of personal responsibility, or a decline in moral standards in recent years. And that certainly played a role... A segment of society always exists that wants something for nothing.

But this doesn't explain how this problem could grow so large.

The real reason is something else...

Real wages for most Americans have been stagnant or falling for decades.

The real (adjusted for inflation) median household income in the U.S. has been flat since at least 1980. And even this figure is misleading, as there weren't as many families with two wage earners then as there are now.

In other words, despite the boom in the economy and financial assets over the past 30 years – which boosted the wealth and incomes of the richest Americans like never before – average Americans are actually worse off than they were decades ago. And they've been forced to borrow more and more simply to keep up.

But it's almost certain you don't know why this has happened. Again, the reason is simple. It's one most folks will never understand, though... and one you'll never hear an economist or government official admit.

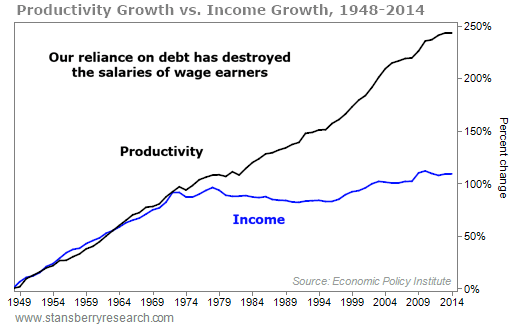

The underlying economic cause is simply that wages are no longer connected to gains in productivity. Here's a chart based on research from the Economic Policy Institute that describes the problem. As you can see, productivity in this country grew nearly 250% between 1948 and 2014, but median wages only grew 109%...

You'll also notice that the divergence begins around 1971... the year President Richard Nixon removed the U.S. dollar from gold. Why? Because paper money doesn't transmit gains in productivity like real, sound money should. In short, when the dollar was unlinked from gold, the government was granted the ability to create unlimited amounts of new money. But this money doesn't flow to everyone equally.

It is created in the banks, and then works its way through the financial system before eventually trickling down through the real economy. The result is that asset and consumer prices have risen far faster than wages.

Simply working harder – or working smarter – isn't benefiting employees anymore. On the other hand, Americans who own assets and businesses have seen their wealth soar over the last 40 years.

And it is this massive gap that is ultimately fueling today's problems.

Porter just released a brand-new presentation detailing all of the facts and the inevitable consequences of our historic debts... and the measures our government will have to take to wipe them away.

Porter and his research team have put the finishing touches on a series of reports for their Stansberry's Investment Advisory subscribers that lay out all the tools individual investors need to protect themselves and their wealth from what's coming.

To see the presentation for yourself – and learn more about Stansberry's Investment Advisory – click here.

Regards,

Justin Brill

Editor's note: Have you heard of the jubilee? In short, it's a truly radical plan to "fix" what many perceive as America's biggest problems: racism, income disparity, poverty, and inequality. But Porter is one of the few expressing serious concern. He and his team recently launched a full investigation into what's coming next. Read their analysis right here.

|

Recent Articles

|