| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Fastest Way to Grow Rich... And Not Risk Everything ElseBy

Friday, December 8, 2017

When I was 33, I decided to become rich. And I made that my supreme and overriding goal.

This decision radically changed my life. I went from broke to kinda rich in about 18 months. I became a decamillionaire about six years later.

Having a single supreme and overriding goal gave me laser-sharp focus and shark-like ambition. Day-to-day business decisions – once complicated – were easy to make. I simply asked myself, "Which is the option that will bring me the most money?" Presto! The choice was clear.

It was also easier to make other kinds of decisions... When a conflict arose between my primary goal (like working all day Saturday) and something else (like spending the day with my family), I chose the former.

I didn't abandon my other duties. I did them as well as I could. But they were always secondary. And it was always noticed... by my family and my friends, and, late at night, by the other little selves that still lived inside my heart.

My strategy was ruthlessly effective. If I were restricted to a single piece of advice for wannabe millionaires, I'd have to offer that as my suggestion.

But you know – as I did even back then – that there are other ways of being rich. You can be rich in your relationships. You can be rich in good health. Or you can be rich mentally – knowledgeable and skillful, but also curious and eager to learn more.

If you want a life that includes these riches as well as a lot of money, you are probably going to have to do what I did when I turned 50. I created a rigid monthly, weekly, and daily protocol for spending my time...

Start by writing down every ambition, desire, and obligation that occurs to you. Then, sort your list into four categories that correspond to the four ways of being rich: money, relationships, health, and personal pursuits.

The next step is to narrow each category down to one broadly defined main goal.

My four main goals looked something like this:

You may be thinking, "Aren't goals supposed to be specific? Shouldn't my financial goal be something like, 'Have a net worth of $1.2 million in 6.3 years'? Isn't that what the experts say?" Yes, they do. But I believe they are wrong. Your long-term goals should be broad because you won't know what you really want until some time has passed. In other words, your goals will likely change as you gain experience... And that's a good thing.

Once you've established your four broad long-term goals, it's time to determine your yearly goals. Within each of the four categories, you might want to list two, three, or even a dozen. Under Personal Goals, for example, you could put down:

As you can see, these yearly goals are more specific than the long-term goals. But they are still fairly broad. Now you are ready to create monthly goals. Again, they will be even more specific. For example, to achieve your yearly goal of writing a book on fly-fishing, you might set your first monthly goal as, "Write the first 30 pages."

Your weekly and daily goals will be even more specific. Weekly goal: "Write five pages." Daily goal: "Write one page."

The reason for this approach is that it's impossible to become wealthy in all four areas of life unless you can see very clearly – on a monthly and weekly basis – exactly how much work you have to do.

By setting your goals from broad to specific, you increase the likelihood of success by decreasing the likelihood of failure. (If you fail to write one page of the book on Tuesday, you can write two pages on Wednesday.)

Most people who try to achieve this balance notice that eventually, some tasks tend to crowd out others. And as time passes, they fall so far behind on certain goals that they give up on them entirely.

Will you have time to accomplish all your goals?

I believe you will. But you have to start off by being realistic. That means you need to recognize from the outset that of the four types of wealth, becoming financially wealthy will take the most time.

We all want to get rich by working four hours a week. But the reality is that you will probably have to spend the bulk of your time – as much as eight to 10 hours a day – pursuing your financial goal.

The good news is that it doesn't take nearly as much time to make progress on your three other main goals.

The main thing to realize is that getting richer in any way requires purposeful action. Desire is not enough.

Nobody else cares whether you have become richer in any of these categories. They will notice... But only you care. And only you can make it happen.

Regards,

Mark Ford

Further Reading:

As Mark said today, making getting rich your top priority is an aggressive wealth-building strategy – but it works. "You can greatly accelerate your journey to wealth," he explains. Learn more here: The First Step to Truly 'Getting Rich.'

"Satisfaction comes from doing something you care about," Mark writes. One way to be rich is to do work that you truly value. Learn more about how you can reach this goal right here: Do You Have a Job or a Career?

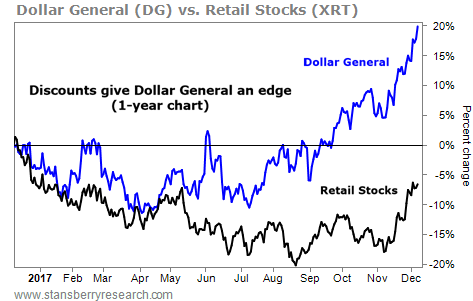

Market NotesTHIS DISCOUNT STORE IS A BRIGHT SPOT IN RETAIL Today, we look at a company that is defying a broader downturn in traditional retail...

Regular readers know we've highlighted the struggles in traditional retail. Brick-and-mortar retailers are floundering as more consumers turn to e-commerce giants like Amazon (AMZN). This year, many traditional retailers have filed for bankruptcy. But some are bucking the trend...

Dollar General (DG) sells everyday items like food, cleaning supplies, and beauty products at lower prices. It aims for the lower-end market that Amazon and its competitors have largely ignored. And its strategy is working... According to the company's latest earnings report, third-quarter revenue grew 11% year over year to $5.9 billion. And while many traditional retailers are shuttering locations, Dollar General plans to open 900 new stores next year.

As you can see in the chart below, the stock is outperforming its peers. Shares have risen around 20% over the past year, and they're now trading at new 52-week highs. By contrast, the SPDR S&P Retail Fund (XRT) is down more than 5%. Clearly, Dollar General's business model has given it an edge in the "retail apocalypse"...

|

Recent Articles

|