| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Steve's note: If you're interested in speculating in cryptocurrencies like bitcoin, Tama Churchouse is the only guy I trust to give you the full story. Unlike most people, he understands both the technology AND how it can make you money. Today, he's sharing how to combat a serious risk that affects all cryptocurrency investors...

On another note, our offices will be closed on Christmas Day. Look for your next issue of DailyWealth on Tuesday after the Weekend Edition.

Don't Touch Another Crypto Until You Read ThisBy

Friday, December 22, 2017

As cryptocurrencies become more and more mainstream... so do the stories of people losing lots of money in these new investments.

Just consider the story about a crypto novice who had more than $100,000 worth of crypto assets stolen. They were stored on his laptop in a hot wallet (that is, a wallet connected to the Internet).

So what happened? He used his laptop in a restaurant on an unsecure public Wi-Fi network... And it appears hackers gained access to his wallet. The next thing he knew, it was empty, and his cryptos were gone – for good.

Before you start buying, storing, and moving cryptos, it's vital that you understand one thing: It is 100% your responsibility to store your crypto assets securely.

Everything in the crypto space revolves around security.

This will be a different way of thinking for most investors... You see, we take far too much for granted now when it comes to our digital financial wealth.

If our credit cards get hacked, we know the credit-card company will foot the bill.

Our bank deposits? Well, it doesn't matter if the bank is creditworthy or not, because the U.S. Federal Deposit Insurance Corporation (FDIC) will cover $250,000 worth of traditional deposits with any FDIC bank. And it's the same story in most other markets around the world.

After the global economic crisis, the prevailing assumption has been that the government will just bail us out if anything goes wrong. The onus of responsibility has shifted away from us as individuals to the government and financial institutions.

But when it comes to crypto assets, make no mistake... the responsibility is well and truly yours. You have very few safety nets – if any. And the safety nets that do exist are the ones that you are responsible for setting up yourself!

That's why you need to make sure you're always following three safety measures when dealing with cryptos...

1. Protect yourself with antivirus software.

Installing up-to-date antivirus software on your Internet devices is just common sense.

It's a basic preventative measure for everything you do online.

But keep in mind, antivirus software isn't a magic bullet. It's like wearing a seatbelt. It helps... But if you drive like a drunken maniac, you're still likely to crash – and you can still get hurt.

So even if you have antivirus software, you still need to practice common sense on the Internet...

2. Stop using the same password everywhere!

I have more than a hundred different usernames and passwords for all my online activities. That includes my brokerage accounts, bank accounts, newsletter subscriptions, and social media sites... It's endless.

But we're all tempted to use the same (or very similar) passwords for numerous different accounts. This is a disastrously bad idea, regardless of how strong the password is.

Everyone knows this. But most people still do it anyway.

Getting into the crypto asset space will require new crypto-exchange accounts and digital wallets... and of course, plenty of new passwords to go with them.

Instead of using short, obvious passwords, try longer ones. The longer and more complicated your password is, the harder it is to crack.

3. Use two-factor authentication.

When you create an account with a crypto exchange, you have one glaring point of failure. Your account and everything in it (including your personal information, address, etc.) is only protected by a single password. This is a recipe for disaster.

But you can protect yourself with a very easy fix. It's called two-factor authentication ("2FA").

2FA is a second layer of security above and beyond your username and password. It means that each time you log in, you'll need to provide an additional piece of information (like a code that is sent to you).

All exchanges allow you to add 2FA. Some insist on it.

And 2FA isn't just for logging in. On an exchange-by-exchange basis, you can activate 2FA for withdrawals from your account as well, providing an extra layer of security.

The three most common ways to add 2FA to your exchange account are through text message verification, e-mail verification, or a 2FA application like Google Authenticator or Authy.

This extra step might seem like a hassle – but it's absolutely critical to protecting your assets.

These are just some of the basic security measures you should know about. Remember... your crypto assets are only as safe as your own security practices.

Good investing,

Tama Churchouse

Further Reading:

"Bitcoin works a little differently than the investments you might be used to," Tama writes. That's why new bitcoin investors need to know three simple things... Read more here: So You Want to Buy Bitcoin... Now What?

"Over the next year or so, we will see much greater sums of money flow into cryptocurrencies," Tama says. And individual investors will have the edge as this plays out. Learn more here: The Big Advantage You Have Over Institutional Investors.

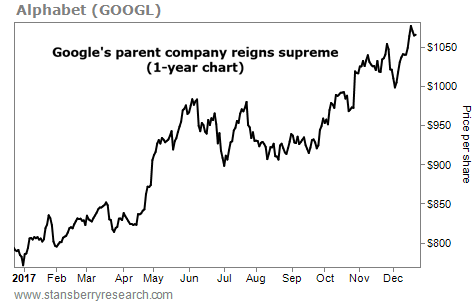

Market NotesTHIS GIANT DOMINATES THE TECH INDUSTRY The king of search engines isn't going away anytime soon...

Longtime readers know investing in "World Dominators" is one of the safest strategies for long-term success. These businesses sport consistent profit margins and healthy cash flows. And their brand recognition often puts them at the top of their industries. Today, we can see this with the parent company of one of the world's most popular search engines...

Alphabet (GOOGL) is a $750 billion colossus. If you've sent an e-mail, stored files in the cloud, or even played music on your smartphone, you've probably used one or more of its products. Alphabet dominates the tech sphere, with business segments in cloud computing, software, hardware, and more. And that gives it a lasting competitive advantage... In its latest earnings report, Alphabet's third-quarter revenue increased 24% to $27.8 billion, while net income rose 33% to $6.7 billion.

As you can see below, this stock is climbing to record highs. The company's Class A shares are up around 32% in the past year. Watch for this tech leader to keep making strides as the market rises...

|

Recent Articles

|