| Home | About Us | Resources | Archive | Free Reports | Market Window |

How the Unemployment Rate Predicts Stock Market CrashesBy

Thursday, February 1, 2018

"In tonight's State of the Union address, President Donald Trump will surely brag about today's low unemployment rate," I said on Tuesday.

I was right. As the president said, jobless claims recently hit a 45-year low.

And as I explained in Tuesday's essay, we can learn a ton from the unemployment rate as stock investors...

Here are the three big things you need to know:

I explained the first two points earlier this week. But this last point is even more interesting...

It's true... The unemployment rate has predicted the last three major U.S. stock market busts: 1990, 2000, and 2008.

Interestingly, the unemployment rate itself isn't the indicator... What matters is the yearly percentage change in the unemployment rate.

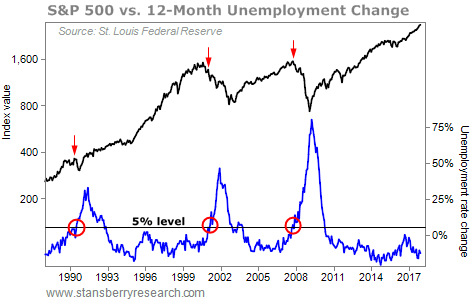

You can see it in this chart. It compares the performance of the benchmark S&P 500 Index with the annual change in unemployment. Take a look...

As you can see, whenever the annual rate went up by as little as 5%, it was time to get extremely cautious. (For context, one example of a 5% change would be if the unemployment rate rose from 4% to 4.2% over 12 months.) Earlier this week, I explained that low unemployment is actually a concern for stocks, based on history...

But we really don't want to own stocks when unemployment is on the rise. A rising trend in the unemployment rate has predicted the last three big falls in stocks over the last 30 years.

Where do we stand today?

The unemployment rate in the U.S. has been falling for nearly a decade. It peaked at 10% in October 2009 and sits at 4.1% as I write.

More importantly, that rate is still falling. It's down 13% over the last year. So this indicator is not signaling a stock market peak – yet.

Of course, this will change at some point. And a quick move to a higher unemployment rate will be a huge warning sign.

In short, this metric provides some great clues about where we are in the stock market...

Today, we are at a near-record low in unemployment. And if that number starts moving in the wrong direction – and quickly – then it will be a serious warning sign for stocks. We are not there yet.

Good investing,

Steve

Further Reading:

A quick rise in unemployment is a bad sign for stocks... But as Steve explained on Tuesday, low unemployment can also signal poor returns for investors. Don't believe it? Get the full story here: Why a Great Economy Means Bad Stock Returns.

"Don't get too enamored with stocks during the 'Melt Up,'" Steve says. He believes stocks could explode much higher in the short term. But the long-term picture looks ugly... Learn more here: Negative 4.6% a Year – the Likely Seven-Year Real Return on Stocks.

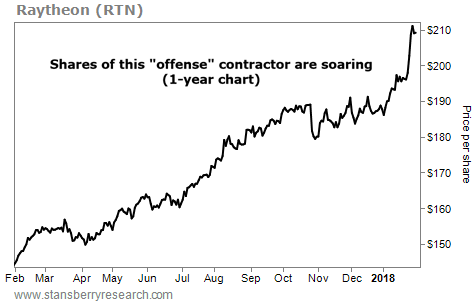

Market NotesWATCH THIS 'OFFENSE' STOCK WHEN TENSIONS RUN HIGH Today's chart highlights the potential of defense stocks...

In the past, we've noted that the U.S. is constantly involved in military action. Defense contractors supply the weapons and technology needed to fight these battles... And with so much government spending on foreign conflicts, we've said these companies might as well be called "offense" contractors. Right now, one military giant is riding this trend...

We're talking about Raytheon (RTN). This $61 billion company makes precision weapons, military electronics, and other defense products. And the business of war is going strong... Raytheon recently reported its 2017 annual revenue increased 5% over the year before. In the fourth quarter alone, Raytheon drew around $6.8 billion in net sales – up 8% from the same quarter in 2016.

As you can see in the chart below, Raytheon shares are up nearly 45% over the past year, soaring to new record highs. As the government continues to spend more on defense, expect shares of this "offense" contractor to keep surging...

|

Recent Articles

|