| Home | About Us | Resources | Archive | Free Reports | Market Window |

Double-Digit Upside Ahead for U.S. StocksBy

Thursday, March 1, 2018

The Dow Jones Industrial Average suffered its worst day in more than six years...

The index fell 4.6% earlier this month. That one-day bloodbath ended the straight march higher in stocks last year. And it helped solidify the first correction in years.

If it spooked you, you aren't alone. But stocks have quickly recovered. The "Melt Up" isn't over yet...

The Dow is only a few percentage points away from new highs today... And history says it should reach them soon.

You see, stocks have a tendency to soar after big one-day falls like this one. It could mean gains of 16% over the next year.

Let me explain...

Corrections happen all the time – around once every two years.

So you don't need to panic just because stocks dipped in recent weeks. Of course, lots of folks were more worried about how stocks fell.

They fell hard and fast.

Again, the Dow's recent one-day loss is the worst we've seen since 2011.

But that kind of fall is also telling...

A one-day fall of 4.5%-plus is rare. It has only happened 29 times since 1950.

Even more interesting, these falls do not have a history of leading to further losses... It's the complete opposite.

An impressive 23 of those 29 falls actually led to stock market gains over the next year. Said another way, you would have made money a year after these falls – 79% of the time!

That's a fantastic batting average. And even better, you could have made good money by buying after these big one-day falls. Take a look at the returns that came after these occurrences...

The Dow has returned about 7% a year since 1950. But you would've done much better by buying after a one-day beating like we saw earlier this month. After the Dow has fallen 4.5%-plus in a day, it has gone on to return 5% in six months and 16% a year later. That's more than double the annual return for the index.

This has worked recently, too... The last time we saw a decline this size was August 2011. The Dow rallied a full 23% the year after that big move.

U.S. stocks have already recovered well from this month's low. The Dow is up around 7% from its February bottom. But history says further gains – and new all-time highs – are likely ahead of us.

So please, stop worrying so much. The Melt Up is still in place. And double-digit upside is likely for stocks in the coming months.

Good investing,

Brett Eversole

Further Reading:

Steve recently shared a contrarian prediction... And if he's right, it could soon fuel another leg up in stock prices. Learn what could help the Melt Up explode even higher, right here.

"The market had its worst week in more than a year – after hitting a 52-week high," Steve writes. This kind of move hardly ever happens in stocks. But history says it could be a bullish sign... Learn more here.

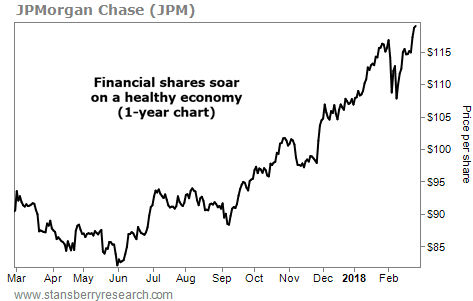

Market NotesANOTHER FINANCIAL POWERHOUSE IS SHOWING STRENGTH Today's chart highlights a major bank benefiting from economic reforms...

We often like to check in on America's "financial backbone" – that is, the country's biggest banks. These include firms like Morgan Stanley (MS), Bank of America (BAC), and Citigroup (C). When big banks are thriving, that typically means our economy is, too... It shows Americans are making and saving money.

JPMorgan Chase (JPM) is among these companies. With $2.5 trillion in assets, it's the largest bank in the U.S. The firm returned about $6.7 billion to shareholders in the fourth quarter. And like many banks, JPMorgan is also benefiting from the recent tax reforms. Its effective tax rate will likely drop from 35% to 19%... And it recently stated that it will use these savings to open new branches, raise wages, and increase lending to small businesses.

As you can see in the chart below, shares are sitting at fresh all-time highs. The stock is up around 30% over the past year. Many expect tax reform to boost economic growth in the U.S. And right now, it's doing wonders for this banking giant...

|

Recent Articles

|