| Home | About Us | Resources | Archive | Free Reports | Market Window |

Use the '95% Win Rate' Strategy to Outsmart a Market CorrectionBy

Thursday, March 8, 2018

The stock market recently underwent a wild gyration.

On February 5, the Dow Jones Industrial Average lost nearly 1,200 points, about a 4.6% fall. And Wall Street's "fear gauge" – the CBOE Volatility Index (or "VIX") – soared by more than 100%.

I know plenty of smart market watchers and professionals who say we're on the verge of a sudden and dramatic decline. It could happen today... tomorrow... or several months from now. Others say the market could go up 50%, or even 100% or more before it tops out.

This could be one of the most uncertain periods in market history...

And that's not good for average investors.

Most of us are hardwired to follow the herd...

A part of the brain called the amygdala drives this response. It consists of two tiny structures deep in the brain that connect emotions and fear. This is the so-called "fight or flight" system.

When individuals don't follow the crowd, their amygdalae start firing. It makes them feel nervous... even sick to the stomach. This was useful in prehistoric days. Our ancestors found safety in numbers when they needed to avoid predators. But it will lead you astray when investing...

I saw exactly this during the market collapse in 2008.

On September 29, 2008, the Dow fell nearly 7% in one day... Investors left the market in droves. By the end of 2008, trillions of dollars were pulled from the stock market.

Within a few months, a new bull market began.

If you threw in the towel and sold your stocks on the way down, or near the bottom in spring 2009, you weren't alone. Many otherwise sensible people did. They were simply following their hardwiring...

And most of these same people waited far too long to get back into the market, too. So even though they've done well the last few years, they're probably kicking themselves for missing out on the really big gains.

Since 2009, the entire S&P 500 Index has returned around 300%, including reinvested dividends.

I don't have a crystal ball. I don't know where the market is going next. But I do know how you can protect your portfolio from a market decline... and stay invested for the majority of any remaining market upside.

For the past eight years in my Retirement Trader letter, I've shown regular investors how to make this bull market work for them. We've collected safe and steady income on some of my favorite stocks. In fact, we've closed winning positions around 95% of the time.

We've racked up these consistent winners by selling options. This has been our go-to strategy... our single-best way of "trading for income" in retirement.

It's a way of protecting the stocks in your portfolio from a dramatic crash, while still enjoying the majority of the market's remaining upside.

Best yet, this strategy is particularly effective when the market has been on a long bull run and valuations aren't cheap anymore... like what we're seeing right now.

You can put on this type of trade on almost any major stock that you likely have in your portfolio.

I'll bet you own at least five – maybe even a dozen or more – of these stocks already. And if you're nearing retirement and sitting on significant gains, you don't want to give those gains back... But you also don't want sell now and miss out on more upside if this bull market continues.

If you're interested in insuring your portfolio from a market correction – while also taking advantage of the end of the bull market – I'm hosting a special demonstration of how this strategy works. The broadcast goes live tonight. I hope you'll join us...

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

"The benefits of the covered-call strategy are clear," Dave writes. Yesterday, he explained how you can invest in one unique fund to take advantage of them... and why now is the perfect time to learn more about selling options. Read more here: The Simplest Way to Use My 'Secret' Trading Strategy.

"You can't build your wealth in the market without accepting some volatility," Dave says. Learn why most corrections are insignificant – and which ones to watch out for – right here: How to Ride out a Correction Like a 'Market Stoic.'

Market NotesBE CAREFUL WITH THESE COIN-TOSS INVESTMENTS Today, an important reminder on the dangers of buying newly listed companies...

Last year was a mixed bag for initial public offerings (or "IPOs"). Streaming-content provider Roku (ROKU) and online-clothing firm Stitch Fix (SFIX) posted big gains in just a few months. But other newcomers were not so lucky. Brand-new or newly public companies may be exciting, but that does not necessarily make them good investments...

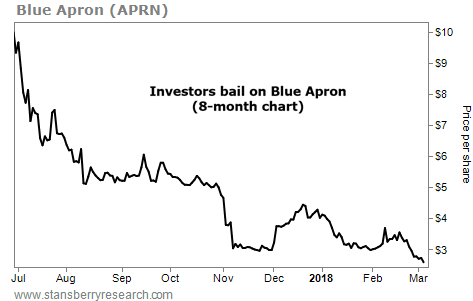

One perfect example is meal-kit-delivery company Blue Apron (APRN). The company's meal kits come ready to go with all the ingredients and recipes you need to cook. It was a popular idea. But the company is having some early struggles... Blue Apron lost more than $200 million over the past year, and customers decreased by 15%. These are big warning flags to new investors...

As you can see from the chart below, the market reacted swiftly... After Blue Apron's first day of trading on June 28, shares plummeted. They're down around 75% in a little more than eight months, and they just hit a new low. It's more proof that buying IPOs is a "hit or miss" game...

|

Recent Articles

|