| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Upside From February's CorrectionBy

Friday, March 9, 2018

I have some fantastic news for you...

Today, stocks are selling at 2015 prices.

If you thought you missed the great run-up in stock prices over the past two years, think again...

Now you have a second chance.

I'm not kidding...

I don't mean that the major stock indexes are at their 2015 levels. We know that's not true.

So let me explain to you what I do mean. It's pretty simple...

Last month, stocks fell further than 10% for the first time in years.

But it's not just that prices fell. There's more to it than that...

Stocks are now at valuations we haven't seen in years.

This creates opportunity. And it's a good sign for our "Melt Up" investments in the coming months.

Stocks haven't been cheap in a while. That's no surprise after a nine-year stock market boom. But market valuations just got a double whammy...

First, stocks corrected, as I explained above. A 10% decline – all else being equal – means stocks are 10% cheaper than they were before. The market has come back a bit since the February bottom, but it's still below all-time highs.

But that's not the only thing that happened...

On December 22, President Donald Trump signed a tax overhaul into law. It dramatically lowers corporate tax rates. And that has led to much higher earnings estimates for 2018.

Bloomberg now estimates that S&P 500 Index earnings will grow 26.2% over the next 12 months...

That's a huge growth number. And a good chunk of it will likely come as a short-term bump, thanks to the tax overhaul.

Thanks to these two factors, stocks just hit their cheapest level in years, based on forward price-to-earnings ratios (P/E), which take current stock prices and divide them by next year's earnings estimates.

You can see the big change in the chart below. Take a look...

In short, valuations fell by 16% in just a few weeks. And they're still cheaper today than they've been in a year... No, the market isn't dirt-cheap today. A forward P/E in the 17 range is still historically expensive. But the market is a better value today than we've seen in a while. You have to go back to 2015 to find a time when the forward P/E ratio averaged 17 for the year.

And that's a good sign heading into the Melt Up.

You see, as regular readers know, I've been calling for a final blastoff in stock prices... a "Melt Up" before the market has its "Melt Down."

I expect the market will rise to much higher valuations in the Melt Up. During the tech boom, the S&P 500's P/E ratio soared above 30.

Those valuations can certainly happen again. And if they do, anyone buying today – after a big step down in valuations – has major upside.

The correction was scary and painful. But today, you can buy into stocks at 2015 valuations. This sets us up for significant upside potential if I'm right about the Melt Up.

So my advice remains the same... Stay long stocks.

Good investing,

Steve

Further Reading:

"Value investing works, AND momentum investing works," Steve says. Learn how this seeming contradiction is playing out in today's market environment, right here: How to 'Call' the Markets Correctly.

"Investors forget about the power of value strategies and need to rediscover them every 10 years or so," Dan Ferris writes. Find out why he believes we're about to enter a "Golden Age of Value Investing" right here.

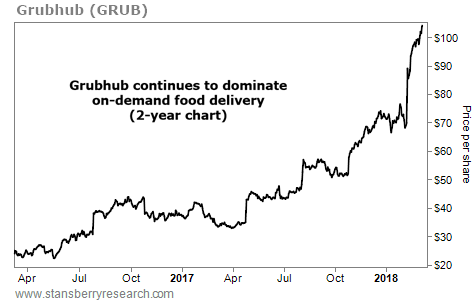

Market NotesTHE BULL MARKET IN FOOD DELIVERY Today, we're checking in on one company that has cornered the "on demand" food-delivery market...

Years ago, if you wanted to order delivery, your options were typically limited to pizza or Chinese food. But today, after the rise of smartphone technology, it's easier than ever to touch a few buttons and have food from your favorite restaurants delivered straight to your door. And chances are good that if you're ordering delivery, you're using Grubhub's (GRUB) services...

The $9 billion company owns Grubhub, Seamless, and AllMenus. With this empire, Grubhub connects hungry diners to more than 80,000 restaurants across the U.S. Last month, the company reported blowout fourth-quarter earnings. Not only that, but it announced a partnership with fast-food giant Yum Brands... which means soon, Grubhub may handle online ordering, pickup, and delivery for more than 20,000 KFC and Taco Bell locations.

Shares recently hit a new all-time high, after soaring more than 200% over the past year alone. As you can see, this strong uptrend in "smart" delivery doesn't appear to be slowing down anytime soon...

|

Recent Articles

|