| Home | About Us | Resources | Archive | Free Reports | Market Window |

Exactly How You Should Trade the Next Market CorrectionBy

Wednesday, March 14, 2018

Well... that didn't take long.

Back in January, my publisher, Stansberry Research, asked its top editors for our No. 1 predictions for 2018.

Mine was straightforward: "[In] the first half of the year... stocks will fall between 12% and 15% and remind investors stocks can indeed take a breather."

Then, early last month, the S&P 500 Index fell more than 10% from its recent high. That was just shy of my predicted range... But it was the first official correction we've seen since 2015.

The fear factor is high. Folks look at their trading accounts or 401(k)s and see thousands – or even tens of thousands – of dollars evaporated. They get upset about their returns. Many of my friends and colleagues have called me to ask what to do...

They don't usually like my answer: It's time to celebrate.

Most people don't want to hear that when the market is in the midst of selling off. But it's true. Let me give you three reasons...

1. This is what stock markets do.

My prediction didn't rely on some magic indicator. It's just what you should expect the market to do.

Consider that we see a 15% correction about every other year. That means one happening within any given six months, like I predicted, is about a three-to-one shot.

If you can't handle the occasional pullback like this, you shouldn't be as invested as you are in stocks. That's just the truth. I'd suggest checking with your broker where you can earn 2.5% in a five-year certificate of deposit ("CD").

2. You shouldn't cheerlead the market ever higher.

As a trader or investor, you should root for corrections to happen more often. That's your chance to snatch up more quality businesses at cheaper prices.

Blue-chip companies like Coca-Cola (KO) or Walmart (WMT) are the same businesses they were two months ago. But you can own a stake in those businesses for less today. You can get bonds or funds at a better price. Even entire countries and regions are on sale.

How is that a bad thing?

You can't have it both ways. For the past year or two, folks were concerned that valuations were too high and it was hard to find businesses that traded at valuations that they felt comfortable with.

Now, the market has fallen and stocks have repriced cheaper... and people are too worried that things are falling to buy in. More often than not, those are all the same people.

I understand that it's human nature to worry, but you'll never be happy if you can't figure out what you want. (Otherwise... CDs.) So unless you need the money today, you should cheer on declines in the market like this.

3. The heightened volatility can earn us more money.

This applies to investors who use my favorite income strategy – selling options.

If you sell options, the higher the option price, the better. And when investors expect higher volatility, they pay more for options.

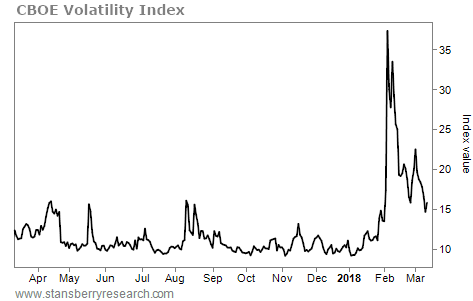

You can see in the price of the CBOE Volatility Index (VIX) – a market-wide measure of expected volatility – that this little market hiccup has traders preparing to pay more for options than they have in months.

That helps us. We can earn nearly double the returns we would have without the rise in volatility – and we'll be buying the underlying shares for lower prices, too. So what do you do now?

You don't need to do anything. Remember, you prepare for a downturn before it happens by owning a diversified group of high-quality businesses with specific exit strategies.

The technical aspects of investing aren't that difficult to understand... It's our natural inclinations and temperament that are so hard to overcome.

We want to run and hide. We want to find an answer. We want to do something.

Resist the panic. Take a breath and look at how this market can be advantageous to you.

Our best evidence suggests that broader declines don't happen often without an accompanying recession. Today, the global and national economies are about as strong as they've ever been.

Other than that, all sorts of assets are trading for lower prices... and options are selling at higher volatilities. Take advantage of it.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

Steve says corrections aren't cause for panic. In fact, he says we could see several as the "Melt Up" plays out. Read more here: Not One, or Two, But FIVE Corrections of 10% Are Possible.

"Monday was a 4.1% move lower," Porter Stansberry wrote last month during the market pullback. "It wasn't a bump in the road. It was barely a ripple on the calmest lake the equity markets have ever seen." Get the full story here: Did Monday's Market Action Make You Panic?

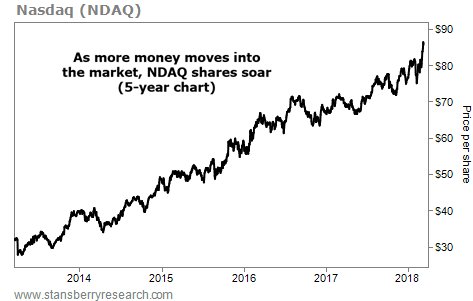

Market NotesA BIG WINNER IN THE 'MELT UP' Today's chart highlights a company that will benefit from Steve's "Melt Up" thesis...

Regular readers know Steve believes we're entering the final stages of this historic bull market... where the biggest gains are likely. If he's right, it could provide a big boost for trading-exchange stocks like Nasdaq (NDAQ).

Nasdaq is the owner of the Nasdaq 100 Index. It's the benchmark index for tech stocks. Its top holdings include companies like Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT). In other words, if you're trading these market leaders, chances are good that you're using Nasdaq's services. The company collects fees as investors buy and sell. So when trading volume skyrockets, NDAQ shares benefit.

As traders and investors continue to pour money into the market, more money flows into Nasdaq's pockets. Including dividends, shares are already up nearly 190% over the past five years... and recently hit a new all-time high. As the Melt Up pushes more investment money into the market, NDAQ shares will continue their surge...

|

Recent Articles

|