| Home | About Us | Resources | Archive | Free Reports | Market Window |

We're Long Gold... AND the DollarBy

Tuesday, November 23, 2010

In the latest issue of True Wealth, one of my recommendations was to BUY the U.S. dollar.

The dollar now is a simple story. It's cheap, hated, and we have the start of an uptrend... It's what we look for in True Wealth, so we're buying.

But paid-up subscriber Jeff called me out on it. In an e-mail, he said...

Steve... Isn't it highly likely that if the dollar rises and the euro declines, that silver and gold will decline?

Great question, Jeff!

I've probably had more subscribers cancel over this idea (buying gold AND buying the dollar) than anything else in the history of True Wealth.

Why? They call me crazy... They say, "You can't bet on a rise in both gold AND the dollar. When one goes up, the other goes down."

That's right... in theory. But occasionally, theory and practice differ. We've successfully capitalized on this numerous times in True Wealth...

The last two times were:

1) In 2005 (starting in the December 2004 issue).

2) In the first half of 2010 (starting in the December 2009 issue).

Both times, the dollar went up (the euro went down), as predicted. And both times, gold went up, too.

It looks like it's happening again. Just yesterday, the dollar was up (the euro was down) and gold was... up! Readers tell me it can't happen. But it does. And we've made money on it.

We're going to again. As I said, the dollar is cheap, hated, and now in an uptrend...

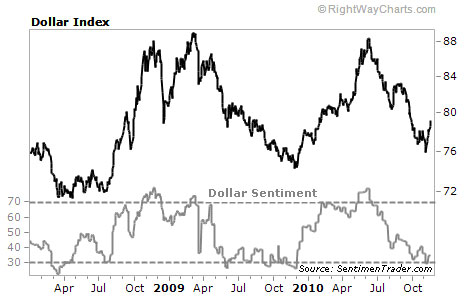

My friend Jason Goepfert does a fantastic job of tracking investor sentiment at www.SentimenTrader.com. The chart below (made with Jason's sentiment data) clearly shows investors are bearish on the dollar... the most bearish they've been this year.

You can also see the dollar has started an uptrend, from 76 to 79. Will it hold? I don't know. But this chart shows the dollar is hated, and it shows the start of an uptrend. What about cheap?

From firsthand experience last week, I know the dollar is cheap. Last week, I was in Europe. The dollar was so cheap, it was near worthless. Here are some actual prices we paid: $90 for pizza and Cokes for four at a small-town pizzeria... $20 for a cheeseburger at a diner... $6 for a soda. (I loved the trip... but I was glad to get back home!)

The dollar rose in 2005... and so did gold. The dollar rose in the first half of 2010... and so did gold.

So can both gold and the dollar rise in the first half of 2011? Yes.

Good investing,

Steve

Further Reading:

Steve helped DailyWealth readers nail the last long-dollar, short-euro trade. Check out his entry here. And his exit here.

Market NotesTHE CONTRARIAN'S COMMODITY IS STILL CHEAP Today's chart is an update on an asset we've been calling the "contrarian's commodity" for the past year. It still deserves the nickname...

You see, nearly every stock and commodity sector has enjoyed a major rally since the 2009 panic bottom. One major laggard is natural gas, a vital fuel for heating homes, firing power plants, and producing chemicals. New drilling methods have unlocked tremendous new domestic supplies of gas... and sent the natural gas price 66% lower over the past few years. This has left the fuel "supercheap" relative to its energy cousin crude oil.

One way to measure the cheapness of natural gas is with the "oil-to-gas ratio." This ratio displays the price of one unit of oil to the price of one unit of natural gas. Since the natural gas price crash, natural gas has been a great bargain when this ratio climbed above 20:1. The fuel isn't such a great bargain when the ratio reaches 14:1.

|

In The Daily Crux

Recent Articles

|