| Home | About Us | Resources | Archive | Free Reports | Market Window |

Your Guide to the Next Triple-Digit Commodity TrendBy

Wednesday, November 24, 2010

For the last 15 years, Russian missiles have powered one out of every 10 televisions in the United States.

It was done through the "Megatons for Megawatts" program, a 15-year-old deal where Russian nuclear missiles became fuel for U.S. nuclear power plants.

The thing is, that deal will expire in 2013. And that's one reason uranium will likely be the next big commodity story... like oil's 250% run from 2005 to 2008 and gold's 180% gain from 2006 to 2010.

Investors who get in position now will see returns that good or better. Here's why...

We can't produce enough today to meet everyone's needs. Mines supply only about 80% of worldwide uranium demand. So we have to turn to old, outdated Cold War weapons. Once they're gone, we're going to need a whole lot more mine production. That's going to take years to come online.

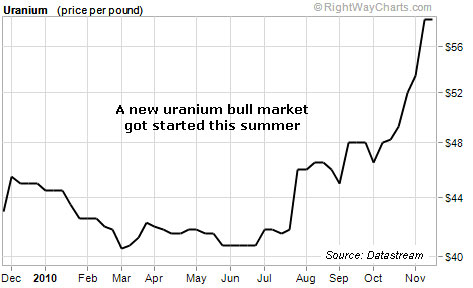

As a result, we're likely to see a run on uranium supplies over the next couple years. The uranium market has already begun pricing in the coming shortage. Take a look...

That's just the beginning. You see, while we're running out of our marginal supply of uranium... we also have a massive nuclear renaissance underway.

Over the next 12 years, Russia will build 26 new nuclear power plants, doubling its current uranium demand. We're seeing similar moves in China and India.

According to the International Atomic Energy Agency, world demand for uranium was 135.8 million pounds in 2009. That will likely rise to 201.1 million pounds by 2020. To meet that demand, we'd need to almost double the amount of uranium mined worldwide in just 10 years.

That's a tall order... So nuclear power companies and uranium miners alike are jostling for control of existing supply. The Russian state-owned nuclear group, Rosatom, recently bought 17% of Canadian uranium miner Uranium One. The deal gives Rosatom the right to purchase up to 20% of Uranium One's global uranium production.

In a similar move to grab future production, Korea Electric Power (KEPCO) agreed to buy 20% of junior uranium company Denison Mines' production.

The Chinese aren't sitting idly by, either. China Nuclear Energy Industry Corporation, a subsidiary of China's largest nuclear generator, signed a deal with Cameco, the world's biggest uranium miner by production, to buy 23 million pounds of uranium through 2020.

And China Guangdong Nuclear Power, which is building more nuclear power plants than any other company in the world, is negotiating long-term supplies with Cameco as well.

Also, China National Nuclear Corporation, which oversees China's nuclear industry, recently announced an agreement with French uranium miner AREVA to buy 440 million pounds of uranium over the next 10 years for $3.5 billion. That's $79.55 per pound… a 34% premium to the current price of uranium.

Nuclear power companies can afford to pay those kinds of premiums to lock in fuel supplies. The cost of fuel makes up less than 4% of the cost to generate electricity. That means power companies are not all that "price sensitive." It won't make much difference to them if they pay $60 a pound or $150.

In other words, the sky is the limit for uranium prices.

There are several ways to invest. You can buy the biggest, most liquid name in the space, Cameco (CCJ). You could also buy the Global X Uranium Fund (URA), made up of 23 uranium stocks. Or you could do what I did in my S&A Resource Report, and buy a handful of the best small-cap uranium miners.

Regardless of the method, you need to be on board the new uranium bull market. It's a large-scale, global trend that will propel us to triple digit gains over the next few years.

Good investing,

Further Reading:

In 2003, a tiny Australian uranium company turned every $1,000 into more than $1 million. "It's unlikely you'll score an unbelievable 100,000% gain," Matt wrote. "But hundreds of percent gains are easily within reach." Learn more here: An Unusual Way to Turn $1,000 into $1 Million in Four Years.

Market NotesTHE GREATEST TRADING STRATEGY KNOWN TO MAN The greatest trading strategy known to man strikes again. This time, it's in gold stocks...

At least once a week, we remind folks how buying assets when they go from "bad to less bad" is a source of incredible profits. It's only when an asset is universally hated that it gets "supercheap" and depressed. When conditions improve just a bit for the hated asset, it can spring hundreds of percent higher.

In the depths of the credit crisis, we recommended a "rebound trade" in one of the most blown out and hated asset classes in the world: gold stocks. Gold stocks are a riskier area of the market... and they suffered one of their worst selloffs in history during the crisis. That's when we turned super bullish.

Today's chart shows the power of the "bad to less bad" rebound trade. It's the huge uptrend in our recommended gold stock vehicle, gold mining fund GDX. After bottoming around $20 per share in late 2008, the fund has skyrocketed nearly 200%.

|

In The Daily Crux

Recent Articles

|