| Home | About Us | Resources | Archive | Free Reports | Market Window |

Silver Wheaton: Still a Double in WaitingBy

Wednesday, October 26, 2011

Shares of Silver Wheaton could double in the next couple years... even if the price of silver goes nowhere.

The gains should be much higher if silver goes up from here. And we believe right now is an attractive entry point to buy silver...

Let me show you why silver is a good buy here... and why Silver Wheaton is the way to play it.

We always want to buy hated assets. And right now, the world hates silver...

In early September, silver was on a hot streak. It rose 29% from its June lows. It held its gains when the market plunged in August. And as Europe's debt crisis escalated, investors flocked to silver as one of the world's safe havens.

But times have changed. Over a two-day span in September, silver fell 22%. Investors panicked and fled the metal as fast as possible.

A chart of silver is the perfect illustration of the pack mentality in the markets...

As you can see, silver has had two major crashes this year. Both resulted in a 20%-plus fall in a few days. Silver has a habit of crashing when the trade gets crowded. But right now, the opposite is going on...

Jason Goepfert of SentimenTrader tracks public opinion of silver. According to Jason, silver just bounced off its most pessimistic reading in five years (as long as he has data).

So what happened the last time we saw investors this pessimistic?

In June, public opinion on silver bottomed. That kicked off its 29% rise to its recent high. We also saw a similar reading in late 2008. From November 2008 to May 2009, silver jumped 60%. Holding from late 2008 until today would have locked in 247% gains...

Those are big returns. But you could have made even more money buying one of our favorite companies... Silver Wheaton.

Silver Wheaton is a royalty company. It invests in silver mines before production begins. In return, it is paid a percentage of the silver the mine produces. It doesn't take any of the mining risk... It just collects a portion of the profits.

When Steve Sjuggerud originally recommended Silver Wheaton in his True Wealth advisory, he described its business as "driving to the bank and cashing royalty checks." He continued, "When your business is depositing big checks payable to you, it's near impossible to lose money."

On top of operating a great business, Silver Wheaton is dirt-cheap...

According to John Doody of Gold Stock Analyst, royalty companies like Silver Wheaton are fairly valued at 20 times royalty revenue...

Silver Wheaton puts 2011 royalty estimates at 25-26 million equivalent ounces. Today, Silver Wheaton nets about $27 per ounce of silver. That means it'll make around $700 million in royalties this year. Apply John's 20 multiple, and Silver Wheaton has a fair market value of $14 billion... around 27% above today's price.

But it gets even better... Silver Wheaton has invested in mines that aren't yet in production. As these mines start producing, the company's royalties increase. By 2015, it expects to collect 43 million ounces of silver. If we apply the same math as above (even though I expect the price of silver to be much higher by 2015), we get a fair market value of $23 billion... over 110% higher than today's price.

Because Silver Wheaton gets paid in silver, it is highly leveraged to swings in price. So when silver sells off, so does Silver Wheaton...

.png) Investors have never hated silver as much as they do now. But they were pretty close at the lows in late 2008. Silver Wheaton shares are up over 800% since then...

I don't expect to make 800% returns. But we could easily double our money over the next few years... even if silver goes nowhere. Our gains will increase if silver pushes higher.

If you like silver over the long term, this is a stock you need to own.

Good investing,

Brett Eversole

Further Reading:

When silver hit a bottom last June, Steve got interested. "If the price of silver goes up," he said, "you could make more than 100% on your money between now and 2015 in shares of Silver Wheaton." Get the details here: Silver Is Hated. Time to Buy. Here's the Best Way...

For the past several years, Doc Eifrig has encouraged everyone he knows to own silver as a "crisis hedge" asset. "Just like I wear my seat belt while driving, I own silver and gold – just in case," he says. Read more here.

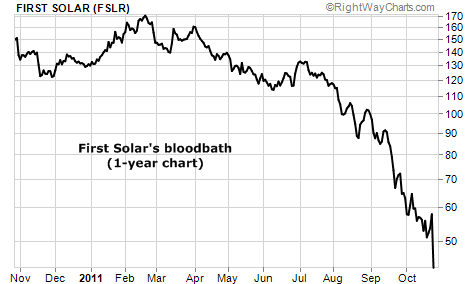

Market NotesHOW TO MAKE 25% IN ONE DAY How can you make a 25% gain in just one day? "Bet against solar stocks," our colleague Porter Stansberry might answer.

Regular DailyWealth readers know we regard most "clean energy" stocks the way we would a lawyer's office: Something to be avoided. Most clean energy firms are such bad businesses, they are "perfectly hedged." That means they lose money in both good and bad economic times. Their stocks stink in both bull and bear markets.

The biggest clean loser right now is the former star of the complex, First Solar. First Solar is one of the world's largest manufacturers of solar cells. But foreign competition and slower sales are crushing the stock.

Just yesterday, the firm's CEO left the company... which caused a huge selloff. Folks who took Porter's advice to short the stock gained 25% in just one day.

|

In The Daily Crux

Recent Articles

|