| Home | About Us | Resources | Archive | Free Reports | Market Window |

This Is Going to Become One of the Greatest Oil Fields in AmericaBy

Wednesday, September 18, 2013

Greetings from the Horseshoe Atoll...

You've probably never heard of the Horseshoe Atoll. That's because this area is more popularly known as the Permian Basin of West Texas.

While a lot of oil has been produced here over the years, a lot more production is on the way.

And chances are good that the companies operating in this area are going to enjoy much higher share prices in the coming years...

The giant, 175-mile-long Horseshoe Atoll is one of the largest buried limestone reefs in the world. Petroleum geologists know these rocks well because of all the wells drilled here. You see, inside the Horseshoe Atoll is a formation that holds one of the world's largest oil fields ever discovered.

One major oil field located here (commonly known as the "Sacroc") went into production in the 1920s. The field produced nearly 1.3 billion barrels of oil over the next 70-odd years. It still produces oil today, with some help. What's key about the Sacroc isn't the oil field itself, but its source.

You see, the best oilfields usually have the richest shales as their source.

For example, the giant oil fields of East Texas are sourced from the now-famous Eagle Ford Shale. The East Texas field produced over 5.4 billion barrels of oil in its productive life. Wells drilled in the Eagle Ford since 2008 now produce over half a million barrels of oil per day.

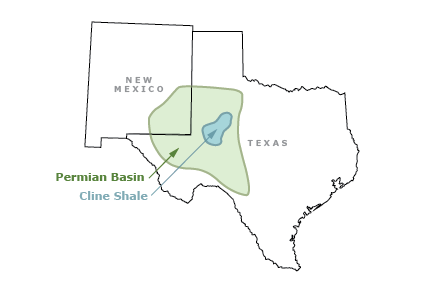

The Cline Shale, which is a large shale formation in the Permian Basin, is on its way to similar production levels. Here's a map of this play:

Mid-cap oil producer Concho Resources (CXO) dropped $1 billion on acreage in the Permian Basin in 2012. And oil producers Devon Energy (DVN) and Range Resources (RRC) are drilling in the Cline Shale today. In July and August, Devon Energy drilled four new wells. As you can see in the table below, these wells added almost 700 barrels of oil production per day and 577 thousand cubic feet (mcf) of natural gas production. The oil production is worth $26 million per year at the current oil price.

Those four wells are just the beginning. Devon is the second largest holder of land in the region – 1.5 million acres. That's enough room for about 8,000 wells. If these wells are any indication, the play could produce well over 1 million barrels of oil per day for Devon. And that is big money.

It's still early days for the Cline, but I expect to see this play develop like the Eagle Ford. For the first couple years, the Eagle Ford's production grew slowly... only to explode in its third and fourth years.

The Cline is absolutely going to explode over the next few years. That's why it makes sense to own companies like Devon Energy. Its Permian Basin production represented 9% of the company's total production in 2012. But as the Cline becomes a world-class field, that percentage will grow.

Good investing,

Matt Badiali

Further Reading:

Frank Curzio estimates the Cline Shale "could contain three times more recoverable oil than the Eagle Ford." And it's already a lot busier than it was six months ago. The good news for investors is "this area is still well under Wall Street's radar." But Frank doesn't expect it to stay that way for long. Get all the details here.

"There's another area within the Permian Basin catching the attention of oil producers," Frank writes. "Early estimates show this small, oil-rich region could contain 50 billion barrels of recoverable oil... making it the biggest oilfield in the county and the second-largest in the world." Learn more about the biggest shale oil play you've never heard of here.

Market NotesIT'S A BIG BULL MARKET IN GAMBLING Feeling rich? Why not hit the tables? Today's chart shows people are doing just that...

Over the past few years, we've detailed many times how the government's "E-Z Credit" policy has driven up asset prices. It's also caused people to shop at Home Depot... stay in hotels... and buy expensive motorcycles.

The Bernanke Asset Bubble is also driving people to gamble. For proof, we look at the Market Vectors Gaming Fund (BJK). BJK is a "one click" investment fund that consists of the world's major casino operators. Wynn Resorts, MGM Resorts, and Las Vegas Sands are large holdings.

Over the past 12 months, BJK is the second-best-performing investment fund of more than 70 that we follow. And as you can see from the chart below, the fund is trading at a 52-week high. It's up 37% in the last year. For better or worse, people are feeling richer... and they feel like gambling.

|

In The Daily Crux

Recent Articles

|