| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: It's Exchange-Traded Fund (ETF) Week here in DailyWealth. And we're sharing the top reasons why we love ETFs. Many investors think ETFs are "boring." But if used properly, they can be a very powerful tool. For instance, with simple ETFs you can...

Access This Billion-Dollar Strategy With a Single ClickBy

Wednesday, February 18, 2015

You could have turned $10,000 into more than $1.8 billion if you'd followed the right investment strategy.

Of course, it would have been nearly impossible for most investors...

There are plenty of complex and profitable hedge-fund-style investment strategies out there. But understanding them and putting them to work in your portfolio are two different things...

Most of these strategies are too complex for individuals. But thanks to ETFs, more and more are becoming available every day, with a single click of your mouse.

Today, I'll show you one of these billion-dollar strategies. And how you can put it to work in your portfolio right now...

One of the major benefits of ETFs is simplicity. If there's a great investment strategy, someone has probably already built it into an ETF.

One of the best (and most complex) available today involves owning companies that buy back their own shares.

Historically this strategy could have turned $10,000 into more than $1.8 billion (from 1928-2009). And today, you can invest in it with a single click, thanks to ETFs.

So why would you want to own companies that buy back their own shares?

Well, when a company buys back its shares, fewer shares are available in the open market. So existing shareholders get a slightly bigger portion of earnings. It's like a secret, tax-free dividend.

Owning a basket of these companies has a history of crushing the stock market. Since 1996, this strategy is up nearly 1,200% versus less than 350% gains in U.S. stocks.

But it'd be nearly impossible to do on your own...

The simple fund that follows this strategy is the PowerShares Buyback Achievers Fund (PKW). It holds more than 200 companies... all of which have bought back 5% or more of their shares over the past year.

Imagine trying to replicate that on your own...

First, you'd need to scan every company that trades in the U.S. You'd need to find the companies that bought back 5% of their stock over the past year.

Next, you'd have to buy the largest 200-plus companies on that list. And you'd have to buy them in the correct weighting. If you bought too much of some and not enough of others, your long-term gains would suffer.

Already, you'd have dozens of hours of work and more than 200 transaction fees. But here's the worst part... the next month, you'd have to do it all over again. And every month after that.

In short, following this strategy would be impossible for just about any investor. But thanks to ETFs like PKW, you can have all of that work done for you.

All you have to do is make a single click and pay a single brokerage fee. That's it!

This simple access to complex, hedge-fund-style strategies is a huge benefit of ETFs.

And with more than 1,000 ETFs available in the U.S., any strategy you'd like to follow likely exists in ETF form. Whether it's something simple like owning the utility sector or something complex like the buyback strategy I described above.

If you aren't investing in ETFs, there's likely a major hole in your portfolio. And funds like PKW are a simple way to fill it.

Good investing,

Steve

Further Reading:

You can find more of Steve's educational content about ETFs right here:

The Safest Way to Pocket Triple-Digit Gains

To make big profits, you DON'T have to take big risks... This Essay Could Literally Save You Millions of Dollars

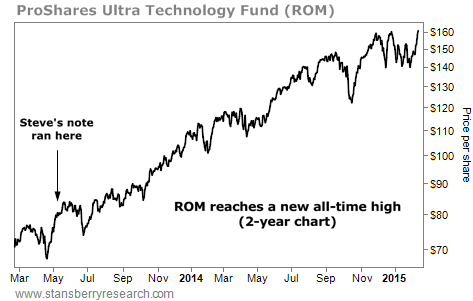

Over a lifetime, these mutual funds could cost you millions... Market NotesSTEVE'S "ONE-CLICK" TECH IDEA IS STILL SOARING If you took our advice to take a "double long" position in cheap tech stocks, you've done extremely well...

Since May 2013, Steve has made a strong case for buying blue-chip technology stocks like Intel, Microsoft, and Google. These companies hold dominant positions in their industries, huge cash hoards, and low valuations.

Steve's favorite way to get exposure to this sector has been the ProShares Ultra Technology Fund (ROM). This fund aims to double the return of a basket of tech stocks.

As you can see below, the fund continues to soar. Since Steve's May 2013 essay, the fund is up more than 110% and just set another new all-time high yesterday. The rally in tech stocks is still on.

|

Recent Articles

|