| Home | About Us | Resources | Archive | Free Reports | Market Window |

It's Not Too Late For Real EstateBy

Tuesday, March 17, 2015

I hope I didn't give you the wrong impression about real estate yesterday...

Yesterday, I explained that I was now buying Chinese stocks – because buying them today is like buying property in the U.S. four years ago. (They're cheap, and investor sentiment on China is terrible.)

Don't get me wrong. I still love U.S. real estate – specifically single-family homes.

I laid out my reasons pretty clearly in the March 2011 issue of True Wealth, and they haven't changed much since then:

The situation is roughly still the same today... Mortgage rates are once again near all-time lows – below 4%. And we are still just getting out from under the worst housing bust in generations. This is when you want to buy.

I got it right back then... House prices in America are up 29% from their lows (based on the benchmark Case-Shiller 20-city house price index).

That's a solid run higher... but it's not even close to the run that we've seen in the stock market.

I believe U.S. single-family homes are a better value than the stock market now... and that there's a lot of upside left.

My money is where my mouth is on this one... I have far more of my net worth in real estate investments than stock market investments right now. (All of that is in Florida, by the way.)

Look, in our zero-percent world, people have nothing to do with their money... They can't earn interest at the bank, or in bonds. They need to find income somewhere. And one place they're finding it today is in rent payments.

So in addition to cheap financing and affordable homes, investors are being driven out of savings in a search of income... and they're finding it in single-family homes.

If you asked me, "Steve, what are you doing with your own money?" I'd tell you that I am WAY overinvested in Florida real estate.

What more can I tell you to show you my strong belief in this idea?

So please, don't look at yesterday's China essay and think that I'm cooling on my belief in real estate. I think this current real estate boom is just getting going...

It's not too late for real estate. Get on board. Don't mess around any longer...

Good investing,

Steve

Further Reading:

Steve still likes U.S. stocks right now, too. Here are two of his latest reasons why:

Rising interest rates do NOT mean that stock prices have to fall...

Stocks aren't nearly as expensive – compared with recent history – as many stock market bears like to think...

Market NotesDOC DOES IT AGAIN One of Dr. David Eifrig's recent stock recommendations is soaring...

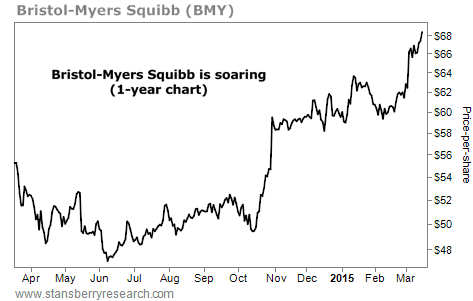

Over the past few years, "Doc" (as we call him) has written many times about how aging baby boomers and Obamacare are creating a massive opportunity for investors in the health care industry. And last September, Doc told his Retirement Millionaire subscribers about the specific opportunity in Bristol-Myers Squibb (BMY)...

Bristol-Myers Squibb is one of America's oldest and largest pharmaceutical companies. Dating back to 1887, its products today include brand-name prescription drugs Abilify and Plavix. But as Doc noted in his issue last September, the company has spent the past seven years transforming itself from a stodgy Big Pharma corporation into a nimble drug developer. Doc believed the move would pay off...

As you can see below, Doc's advice was well-timed. Over the past six months, Bristol-Myers Squibb has gained 37%... and just yesterday, shares hit a new all-time high.

|

Recent Articles

|