| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today's essay comes from our friend and colleague Mark Ford. Mark is a multimillionaire entrepreneur and educator who has practiced and taught every wealth idea worth knowing.

Below, he shares one of his favorite ways to grow lasting wealth (and collect 12 more paychecks next year). It's one of his all-time favorite strategies. See if you might pledge to add it to your own portfolio this year...

New Year's Pledge: Automatic Wealth Through Rental Real EstateBy

Monday, January 4, 2016

Do you invest in real estate?

I'm not talking about your home. Owning a home has more to do with security (emotional and personal) than it has to do with building wealth.

I'm talking about rental real estate.

If you aren't investing in rental properties, you should think about doing so today...

I love real estate. It's not without its problems, but it's the best way I've found to accumulate a good deal of wealth on a part-time basis.

In the many years I've been actively investing in real estate, it has given me returns much better than the stock market. In fact, my average return has been between 5% and 8%, without leverage. When I use bank financing, those numbers are in the 12%-15% range.

I've tried all sorts of real estate investing. But I've gotten the best results by sticking to this plan: direct investments in income-producing properties... either residential or commercial.

You receive something with rental properties you don't get with many other real estate deals: guaranteed income. Sure, you get appreciation, too. But I've come to see that as secondary to having dozens of extra, ongoing income streams. (And did I mention it's money that comes with little to no extra work for you?)

Wouldn't it be nice to wake up one day and realize you don't need to work anymore? Imagine how it'd feel to have checks sent to you each month. Checks that, in total, were enough to pay all your bills.

It's an attractive prospect, don't you think? You can make it happen by building a substantial real estate retirement portfolio.

If you're relatively young (meaning retirement is 20-plus years away), you can do it easily. If you're closer to retirement – or already retired – you can enjoy the benefits as well... though you'll need to work a bit harder and/or invest a bit more money.

I made more than 500% on a house my brother rented from me. He and his family stayed in it for three years, paying below-market rent (which he appreciated). Yet I was able to make consistent income... and I was able to sell it for more than twice what I paid for it.

Since I financed it at 80%, my return in the end was huge... even when you take into account all the costs. These include the cost of borrowing, the maintenance, and the theoretical loss of income by charging a modest rent.

I netted something like $10,000 per year on a condo I bought for $65,000. That was a return of roughly 15%, cash on cash. (Cash-on-cash return = annual dollar income / total dollar investment.)

Had I used bank financing, I would've made more – without any significant increase in risk.

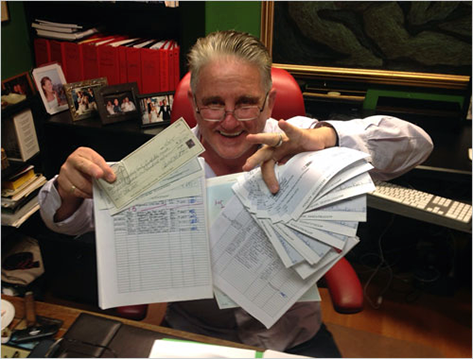

I own dozens of individual properties like this. They send me checks – usually thousands of dollars – on the first of every month. That's a nice way to begin your month.

Mark on his favorite day of the month: the first.

On the credenza are 24 small red binders. Each represents a separate real estate investment I'm involved in. Some are individual properties I own myself. Some are properties I own with friends. Some are direct investments. Some are in partnerships or corporations. Some are rental plays. Some are build-and-sells.

If you decide this is the year to begin a real estate portfolio, start slowly.

My first real estate investment was a bad one. I've written about it before. It was a rental unit in Washington, D.C. (It was overpriced and occupied by a prostitute who would neither pay me rent nor do her business elsewhere.)

It took me years to dig myself out of that mistake. I emerged a smarter (but not-yet-smart-enough) real estate investor.

Take your time. Be selective. Educate yourself. Some of what's on the bookshelves is full of misguided advice.

My best advice is to subscribe to our rental real estate program. It's part of the Palm Beach Research Group's Wealth Builders Club. That, you can trust.

You can also take adult education classes... if you can find them. Be leery of free seminars –they're likely to be selling traps.

Here's a promise: If you start investing in rental real estate this year, you'll be glad you did. If you keep investing – buying at least one new property per year (which will be easy once you get going) – you will be a real estate multimillionaire in no time (not counting your other assets).

And you'll be well on your way to retiring as a multimillionaire.

When you look back on all the wealth you acquired, you may feel the way I do now: that real estate was the easiest and – next to your personal business – most lucrative wealth-building activity you ever got involved in.

Regards,

Further Reading:

You can find other wealth-building ideas from Mark right here:

Every hour that you put in today will be worth many times that amount later on. The rewards can be extraordinary if you think of them in terms of money.

It's a common mistake, but you won't hear it mentioned by retirement experts...

"You may be surprised at how dramatically you can improve your future income..."

Market NotesNEW HIGHS OF NOTE LAST WEEK

Kroger (KR)... grocery store

Kellogg (K)... Big Food

McDonald's (MCD)... fast food

National Beverage (FIZZ)... soft drinks

Dr Pepper Snapple (DPS)... soft drinks

Pep Boys (PBY)... auto parts

Snap-on (SNA)... hand tools

Six Flags Entertainment (SIX)... amusement parks

General Electric (GE)... giant conglomerate

Carnival (CCL)... cruises

Royal Caribbean (RCL)... cruises

Equifax (EFX)... credit-reporting agency

Chubb (CB)... insurance

Alphabet (GOOG)... search engine

Activision Blizzard (ATVI)... video games

Microsoft (MSFT)... software

NEW LOWS OF NOTE LAST WEEK

SandRidge Energy (SD)... energy stock

Barnes & Noble (BKS)... bookstores

Bed Bath & Beyond (BBBY)... home furnishings

Rent-A-Center (RCII)... rent-to-own

Chico's (CHS)... women's clothing

Sotheby's (BID)... auction house

Chipotle Mexican Grill (CMG)... burritos

|

Recent Articles

|