| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why Oil Prices Could Continue FALLING From HereBy

Thursday, February 4, 2016

Oil prices HAVE to go higher... Or do they?

Crude oil is already down 17% this year. It broke into the $20 range last month. And the total fall since July 2014 is 72%.

You (and nearly everyone else) expect much higher oil prices after a crash like we've seen. But that's the problem...

Everyone expects oil prices to rise from here. I'm not saying the crown can't be right. But when everyone believes something, the opposite tends to happen. And that means lower oil prices from here are entirely possible...

What's most incredible about the fall in oil is that investors are still optimistic today. Like I said above, nearly everyone expects higher prices right now.

In fact, speculative bets on higher oil prices through exchange-traded funds (ETFs) have soared.

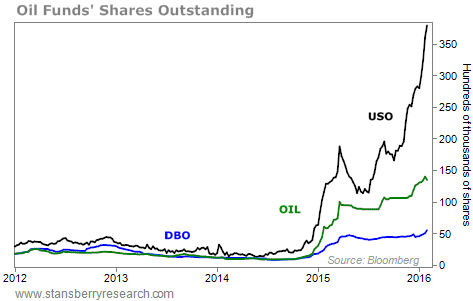

The chart below shows the shares outstanding for the largest three oil ETFs – the United States Oil Fund (USO), the iPath S&P GSCI Crude Oil Total Return Index Fund (OIL), and the PowerShares DB Oil Fund (DBO). These funds create and liquidate shares based on demand. So a rising share count shows investors are betting on higher oil prices.

Bullish bets soared in recent months as oil broke down to new lows. Take a look...

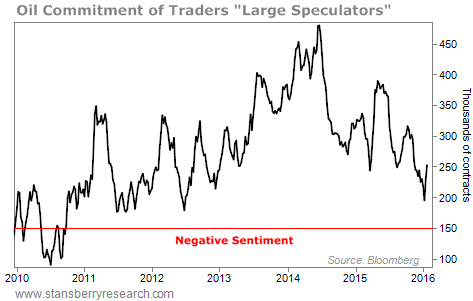

Combined, the three funds contain more than $4 billion in assets. That's real money betting on higher prices. If we look at a larger market – the futures market – we again see that investors aren't at a negative sentiment extreme for oil. The chart below shows the Commitment of Traders ("COT") report for oil.

The COT report is a weekly report that shows the real-money bets of futures traders. It often acts as a contrarian indicator... When most futures traders bet against an asset, the asset is poised to bounce.

Today, the COT report shows futures traders are getting negative on oil. But they aren't at an extreme today. Take a look...

The chart shows "large speculators" in the oil market. They are considered the "dumb money" and are often wrong when they agree. Obviously, bets have fallen dramatically from the mid-2014 extreme, which kicked off oil's dramatic fall. However, sentiment can still fall much farther before hitting a negative extreme.

Of course, none of this means an oil rally isn't possible. But right now, ETF investors are wildly bullish on oil. And futures traders aren't at a negative sentiment extreme.

The consensus on oil is that prices HAVE to go higher. I don't buy it. Sentiment is too positive. And that means the oil decline will likely continue.

Good investing,

Brett Eversole

Further Reading:

Earlier this week, Brett and Rick Crawford wrote about the multiyear buying opportunity shaping up right now in emerging markets. "History shows we could see 16% gains over the next year," they say... "And triple-digit gains are possible over the next five years." Learn why right here.

With oil and stocks crashing, it's tough to find investments that are holding up these days. Steve says if you're looking for a safe place to put your money, consider residential real estate in your area. Get the details here: Why My Money Is on U.S. Real Estate Right Now.

Market NotesTHIS WORLD DOMINATOR JUST HIT A NEW HIGH One of the all-time great investment strategies is paying off again...

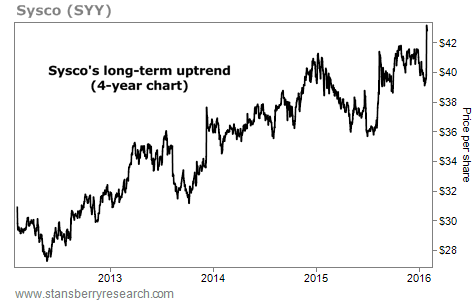

We're talking about owning the world's strongest, safest businesses. These companies dominate their industries. They have the best brand names, the biggest competitive advantages, the biggest profit margins, and they pay the safest dividends (think Johnson & Johnson, Microsoft, and Coca-Cola). And right now, shares of one of these companies are rocketing higher: Sysco (SYY).

Sysco is the World Dominator of the North American food-service-distribution industry. The company sells hundreds of thousands of different items – including fresh produce, dairy, canned goods... paper, kitchen utensils, and other equipment – to restaurants, hospitals, hotels, schools, and colleges throughout the U.S. and Canada. With 196 distribution centers, no other player can match Sysco's presence in the industry. And Sysco is an elite, long-term, dividend-growth company, having paid a dividend every year since it went public in 1970.

As you can see from the chart below, Sysco has been on the fast-track higher... Shares are up 20% since last summer and just catapulted to a new 52-week high. It's a world-class company that will continue treating shareholders well for years to come...

|

Recent Articles

|