| Home | About Us | Resources | Archive | Free Reports | Market Window |

How to Live Like a Billionaire on $100K... or LessBy

Wednesday, February 10, 2016

I grew up poor, the second of eight children. My father earned $12,000 per year as a college professor.

As a teenager, I was ashamed of our small house, my hand-me-down clothes, and my peanut butter and jelly sandwiches.

I dreamed – literally dreamed – of living like a rich man.

So when I got my first job at age 9 as a paperboy – and then, at age 12, as a lackey at the local car wash – I'd spend my money on luxuries, like a pair of brand-new Thom McAn shoes.

I worked every chance I got through high school. Then I worked two or three jobs during college and graduate school. I spent 80% of my money on necessities: food, clothes, and tuition.

But I always spent a bit on little niceties. Even then, I felt I didn't need to deprive myself now for some better life later.

I tell you this to emphasize a key part of the simple money-management system I've used to generate more than $50 million in wealth...

I don't believe in scrimping severely to optimize savings.

You can live a rich life while you grow rich, so long as you're smart about your spending... and willing to work hard.

Think of the typical earning/spending/saving pattern of most wealth seekers...

During their 20s, they spend every nickel of their modest incomes to make ends meet. At that age, it's almost impossible to put aside money for the future.

During their 30s, their incomes increase. But this is also when they start families. Expenses soar. There are more mouths to feed, a "family" car to buy, and the dreaded down payment on a first house.

They manage to save a little during these years, but nowhere near as much as they thought they would.

If they work hard and make good career decisions, their incomes will climb much higher in their 40s and early 50s. They'll have more money to put aside for the future.

But they'll also be tempted to buy newer cars, nicer clothes, more exotic vacations, and – the biggest wealth stealer of all – their dream house.

In their late 50s and 60s, their incomes plateau or even dip... and they may have to start shelling out for college tuitions. Aware their retirement funds are being depleted rather than enhanced, they invest aggressively to try to make up the difference.

Finally, sometime in their mid-to-late 60s, they realize they don't have enough money to retire. They've spent almost 40 years working hard and chasing wealth, but they never managed to attain it.

It's sad, but it's a reality for most people. And it's just as true for high-income earners (doctors, lawyers, etc.) as it is for working-class folks.

There are two lessons to be drawn from this:

Setting unrealistic investing goals means taking greater risks. And taking more risks – contrary to what many pundits say – will almost always make you poorer... not richer. The truth is there's only a marginal relationship between how much you spend on housing, transportation, vacations, and toys and the enjoyment you can derive from them.

My spending strategy is simple: Discover your own less-expensive way to live a rich life.

By a "rich life," I mean a life free from financial stress, filled with things that give you pleasure.

For example... good, restful sleep is essential for a happy life. Ideally, you're going to spend around one-third of your life sleeping. So rather than "pay up" for an expensive car or necklace, buy a great mattress.

By getting a great mattress (which can be bought for less than $2,000), you'll sleep as well as any billionaire... and be just as happy.

Your family can be just as happy in a house that costs $100,000 or $200,000 as they'd be in one that costs $10 million or $20 million. Likewise, a $25,000 car will get you where you want to go just as well as a car that costs 10 times that amount.

There are dozens of ways to live like a millionaire on a modest budget. If you learn those ways, you'll have a tremendous advantage over everyone else at your income level.

Make smart spending decisions. Stop thinking that because you're earning more money, you should be spending more. Your future wealth is determined by how much you save and invest – not by how much you spend.

So here's what I'd like you to do: Figure out how much you need to spend every year to live your own personal version of a "rich" life.

It might help to spend a few minutes thinking about all the things you truly enjoyed last year. If you're like me, you'll find almost all the things you enjoy require little money. (Those are the true luxuries.)

Keep the biggest wealth-stealing expenses – like your house, cars, and entertainment – to a necessary minimum. And nix any expenditure with a brand name attached to it. Brand names are parasites that gobble up wealth.

Don't nod your head and promise to get to it sometime in the future. Do it today. Estimate – as best you can – how much you need to spend each year to have the life you want.

This is a number you must have firmly in your mind if you intend to be a serious wealth builder.

This simple system for managing money can work for you... if you commit to it.

It helped me build a net worth of more than $50 million – and it's still working for me and everyone else I know who's tried it.

So today, spend the time it takes to establish your own approach to "living rich" now... and in the future.

Regards,

Mark Ford

Further Reading:

Last month, Mark shared one of his all-time favorite ways to grow lasting wealth. To learn more about what he says is the best way to accumulate a good deal of wealth on a part-time basis, click here.

In December, Mark told readers the three most important skills you need to be successful in life. "If your children learn these, they'll be set for life," he says. Learn what they are in this essay.

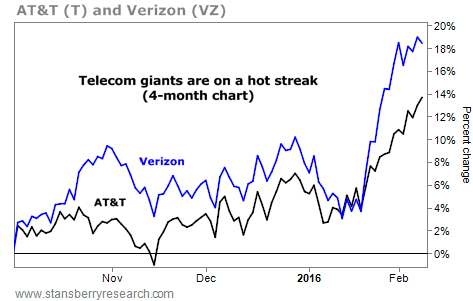

Market NotesTHESE TELECOM GIANTS JUMP HIGHER It has been an impressive few months for two of the biggest players in the telecom industry...

In the past, we've compared the telecom business to a toll bridge. These companies build and maintain expensive networks to provide the best services... and people pay every month to gain access. And because the costs to build a new network (the "bridge") are astronomical, it's nearly impossible to compete with the dominant players.

We can see this by checking in on the performance of industry giants AT&T (T) and Verizon (VZ). Combined, they control around 60% of the wireless telecommunications market in North America. They both have steady income streams and collect regular payouts for the use of their valuable infrastructures.

As you can see below, both companies have enjoyed a solid boost of late. They're up around 10% over the past month alone, and recently struck new 52-week highs. It's a case study in a fantastic, cash-gushing business...

|

Recent Articles

|