| Home | About Us | Resources | Archive | Free Reports | Market Window |

A Perfect Setup: Hard to Find These Days, but This One Is CloseBy

Tuesday, February 23, 2016

What's the perfect setup for an investment?

I like to see a couple things:

You see, when people have given up and say "things can't possibly get worse"... you are often near the bottom. The catch is, you don't want to be near the bottom... you want to be PAST the bottom. So the perfect setup is when you have incredible fear AND the start of an uptrend.

This is where the biggest gains happen... I say it's the time when things go from "bad" to "less bad." We saw it in gold stocks in the last couple weeks... Things went from bad to less bad, and gold stocks soared.

And we have a similar "bad to less bad" opportunity shaping up today...

Grains – specifically wheat, corn, and soybeans – need to be on your radar right now.

Wheat hit its lowest level in nearly six years a couple weeks ago. It's down roughly 50% since 2012. And the other big "grains" – corn and soybeans – have fallen even farther.

U.S. farmers are so paralyzed by these lower prices, they are afraid to plant. Why plant something that you will lose money on when you harvest it?

The U.S. Department of Agriculture put out a crop report last month, saying "U.S. farmers sowed 36.6 million acres of winter-wheat varieties." That was the second-smallest planting since 1913. The acreage of wheat planted in Nebraska was at a record low.

We have record fear in wheat... We have no supply coming from U.S. farmers, and bets against the price of wheat hit a record in January in the financial markets. Corn and soybeans are in similar positions, though not as extreme.

But something interesting is brewing...

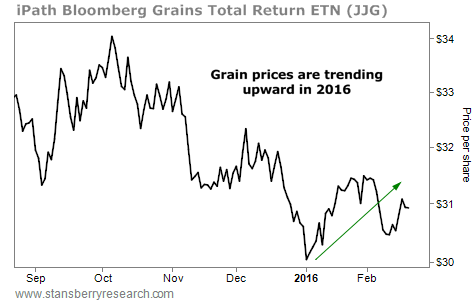

Even though fear is high in the "grains," prices are actually up since the start of this year – in a world where most other asset prices are down. Take a look:

It's a small move, I realize. But it could be the start of a major "bad to less bad" rally... Right now, you could set things up so that your downside is extremely limited... and your upside potential is dramatic.

I'm talking about buying the "grains" fund... the iPath Bloomberg Grains Total Return Fund (NYSE: JJG). JJG is an exchange-traded note that tracks the prices of just three grains: corn, soybeans, and wheat.

The all-time low in JJG is only about $1 below today's levels.

I suggest setting your stop at the all-time low, limiting your downside risk, in case I'm wrong.

We are trading on this idea in my True Wealth newsletter (though our stop loss is different from the all-time low).

I could be early on this idea... but on a risk-versus-reward basis, this trade looks pretty good. It is not far from being the perfect setup... in a world where perfect setups are hard to come by.

Check it out...

Good investing,

Steve

Further Reading:

"Everyone wants to be the hero and call the bottom," Steve says. "But the bottom doesn't happen until everyone gives up." Right now, investors are still trying to perfectly time the bottom in oil and energy stocks. Instead of betting on a recovery, learn what you should be doing instead right here.

Steve says to also consider buying platinum today if you haven't already. Today, it's 1) cheap, 2) hated, and 3) in an uptrend. Read his bullish argument here: The 'Rolls-Royce' of Precious Metals.

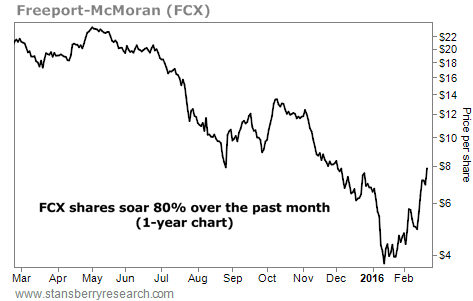

Market NotesA HUGE 'BAD TO LESS BAD' RALLY Today's chart highlights a major "bad to less bad" move happening right now in natural resources.

As Steve mentioned in today's DailyWealth, the biggest gains often come when assets go from "bad to less bad." And right now, Freeport-McMoRan (FCX) – one of the crown jewels of the resource industry – is showing just how powerful this trading strategy can be. Freeport owns the famous Grasberg mine in Indonesia – the world's largest gold mine and third-largest copper mine. After sliding lower for most of the past year, FCX is showing signs of life.

From July 2014 to the end of last year, shares of FCX suffered along with most natural resource stocks, falling more than 80%... but as you can see from the chart below, the $9.7 billion company has reversed course in 2016.

Shares have nearly doubled over the past month... making it one of the best-performing stocks during that time frame. It's more confirmation that there are huge gains to be made as things get "less bad" in resource stocks...

|

Recent Articles

|