| Home | About Us | Resources | Archive | Free Reports | Market Window |

Four Keys to Sidestepping This Huge Retirement RiskBy

Wednesday, March 30, 2016

Over the last century, the average bear market has lasted almost exactly one year, according to Ned Davis Research. The average recovery to a new all-time high took the market an additional 2.1 years.

So long-term investors who plan to put fresh money to work should not wish for the market to keep going up – because that would only mean investing in equities at ever-higher prices – but rather pray that it starts going down, so that they can invest at lower prices.

Bear markets are an enormous opportunity for the accumulation of retirement assets. (Although far too few folks see it that way.) Yet for another group of investors, they pose a serious risk.

I'm referring to those just entering retirement. They face what is often called sequence-of-returns risk. And it can be a serious challenge.

Here's what I mean...

One of the toughest potential developments for any individual with equities is retiring right into the teeth of a bear market. If you are forced to make withdrawals early in retirement from a portfolio that is rapidly declining in value, there will be fewer shares left to benefit when the market eventually rebounds.

And while an average of 3.1 years (one year of decline followed by 2.1 years of recovery) from one bull market top to the next may not sound that long, history shows it could take years longer.

The bear market that began in 1973, for example, took almost 12 years to reach a new high. So prepare in advance for sequence-of-returns risk with four key steps.

There are other non-investment-related moves you can also make to maximize the life of your portfolio in retirement. These include cutting costs, downsizing, or plunking for a low-cost immediate fixed annuity like the kind Vanguard brokers. (This is the only type of annuity worth considering, in my view. The rest benefit the annuity salesman far more than the purchaser.) In short, your primary investment goal in retirement is to make sure your portfolio doesn't kick the bucket before you do. A bear market that begins right after you leave the workforce can be a substantial challenge. But follow the four steps outlined above, and you can easily sidestep potential sequence-of-returns risk.

Good investing,

Alexander Green

Further Reading:

Earlier this year, Alexander explained why you can't act on emotions and expect to prosper in the stock market. "Panicking is for when a toddler in your charge suddenly darts into the street," he says. "It has no place in portfolio management." Learn what he says the key to long-term investment success is right here.

Expert wealth-builder Mark Ford believes the conventional dream of retirement is not very satisfying as a reality. That's why he says you should "never retire." Learn more about Mark's strategy in this interview.

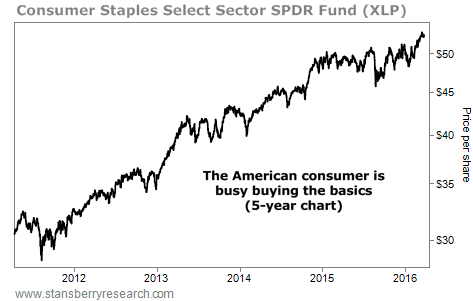

Market NotesAN UPDATE ON THE AMERICAN CONSUMER Today's chart tells us that once again, the American consumer is alive and well... and he's out buying the everyday "basics"...

With gas prices so low at the pump, Americans have more money in their pockets... and they're loading up on consumer staples. These include things like beer, cigarettes, and soda. We've covered the importance of these types of products many times before. In short, these items are never in danger of going obsolete.

We can see this trend by looking at the Consumer Staples Select Sector SPDR Fund (XLP). This fund holds many world-class companies we've featured before, including consumer-goods company Procter & Gamble, soft-drink giant Coca-Cola, retailers Wal-Mart and Costco, cigarette maker Philip Morris, and drugstore CVS Health.

The performance of XLP can tell us a lot about the state of the economy... If people are spending money on these types of "boring" goods, things can't be all that bad. As you can see below, XLP is locked into a long-term uptrend. Shares are up nearly 80% over the past five years. And the stock continues to tick higher today...

|

Recent Articles

|