| Home | About Us | Resources | Archive | Free Reports | Market Window |

A Six-Month Boom in Emerging Markets Starts NowBy

Monday, April 18, 2016

After a five-year bear market, the rally in emerging markets has officially begun...

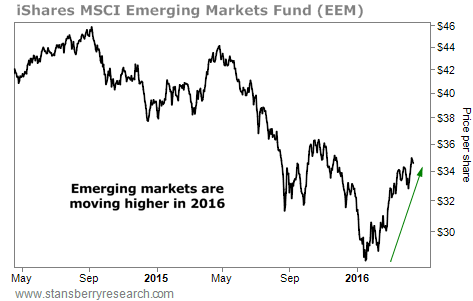

The iShares MSCI Emerging Markets Index jumped 20% from mid-January to mid-March. A move that big is rare. But as I'll show you today, these gains should continue from here.

More specifically, this kind of jump has happened less than 3% of the time since 1988. And history says it could lead to 12% gains over the next six months.

Let me explain...

From January 21 to March 21, emerging market stocks rallied 20%. And they're now up 23% in total since their January bottom.

This is a BIG move to the upside. Emerging markets have fallen for most of the last two years. But now they're taking off. Take a look...

The big question is where do we go from here, and what does this big rally mean for emerging markets in the next few months? The answer is a potential boom in emerging markets.

You see, I looked at every instance of similar 20%-plus two-month jumps in emerging markets. As I said earlier, they don't happen often – around 3% of the time. But history says further gains are likely after these rare upside moves.

The table below shows the returns from previous rallies. Take a look...

These results might surprise you. Buying after a major boom might seem like a bad idea. But it's exactly what we should do. As the table shows, emerging markets outperformed a normal "buy and hold" strategy after these occurrences. History shows average gains of 5% over three months... and 12% gains over six months.

This is a big opportunity. Emerging markets are cheap after falling for several years, and investors aren't interested in owning them. Most folks expect the losses to continue.

Meanwhile, these stocks are jumping higher... and those gains will likely continue.

History says we could make double-digit gains over the next six months. But if this is the beginning of a long-term boom in emerging markets, we could see gains much higher in the coming years.

The trend in emerging markets has been down for years. But that's ending today. Prices are heading higher. And right now is the time to buy.

Good investing,

Brett Eversole

Further Reading:

Steve says now is also the time to buy gold. Read his recent bullish essays below:

Market NotesNEW HIGHS OF NOTE LAST WEEK

Honeywell (HON)... manufacturing

3M (MMM)... manufacturing

Masco (MAS)... building materials

Public Storage (PSA)... self-storage REIT

Kimberly-Clark (KMB)... consumer-products giant

Colgate-Palmolive (CL)... consumer-products giant

Becton Dickinson (BDX)... medical devices

Energizer Holdings (ENR)... batteries

Philip Morris (PM)... cigarettes

Altria (MO)... cigarettes

Vantiv (VNTV)... payment processor

Johnson & Johnson (JNJ)... health care giant

Agnico Eagle Mines (AEM)... gold stock

Kinross Gold (KGC)... gold stock

Newmont Mining (NEM)... gold stock

Franco-Nevada (FNV)... gold stock

Seabridge Gold (SA)... gold stock

AngloGold Ashanti (AU)... gold stock

Fortuna Silver Mines (FSM)... silver stock

First Majestic Silver (AG)... silver stock

NEW LOWS OF NOTE LAST WEEK

Not many... S&P 500 climbs 12% over the past two months.

|

Recent Articles

|