| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: We've been writing a lot about gold over the past month – and for good reason. Stansberry Research founder Porter Stansberry says we stand on the precipice of "one of the biggest bull markets in gold the world may ever see."

But many investors aren't thinking about gold the right way. Over the next two days, Porter will share how to avoid that mistake... and why it's critical that gold has a place in your portfolio today...

Reduce Your Risk AND Boost Your Returns by 40%-Plus AnnuallyBy

Wednesday, April 20, 2016

In today's essay, I'm going to share with you a HUGE secret, something that most investors will never understand.

This secret will double your portfolio's total return going forward, while reducing the volatility of your investment returns.

It's the only real "holy grail" in investing. Nothing works all the time. Nothing is a free ride. And nothing is guaranteed to always make big returns. Getting better as an investor means improving your results over time and reducing the amount and duration of your portfolio's pullbacks.

Today, I'm going to show you a foolproof way to do that and explain why now is exactly the right time to set your portfolio up in this way. This won't cost you a dime – except maybe some minor trading costs. And yet... I know most of you won't do it.

You see, today's topic is about gold. And by the end, you'll see why you should have gold in your portfolio – especially right now...

Generally speaking, there are two kinds of investors. There are, of course, investors who own gold. You probably know some of these folks. These investors typically believe the world is on the verge of a crisis. So they own gold and gold stocks... and almost nothing else. They generally have poor results. Their portfolios are incredibly volatile, and over time, they drastically underperform the stock market as a whole. These investors, however, carry these scars as a kind of badge of honor, proving their fealty to sound money. No matter what, they will never change.

Then there's the other kind of investor, the ones who trade stocks and bonds, buy mutual funds or exchange-traded funds (ETFs). These investors drive fancy cars, take exotic vacations, and send their kids to expensive colleges... financed by equity investments made 20 or 30 years earlier. These investors generally regard gold as the "loony" sector of the market. They won't have anything to do with gold, no matter what.

These investors are, in my opinion, making a huge mistake. They don't understand the proper use of gold and why owning it (at the right time, not all the time) would be the smartest financial decision of their lives.

But as I promised at the onset of today's essay, gold can reduce your portfolio's volatility and increase your total portfolio returns by at least 40% annually. So... please... do me a favor. Just once (nobody's looking) open your mind and drop your defenses. You don't need to think of gold as an idol... or a useless relic. It's simply an asset class with unusual properties. It's the ultimate financial insurance.

Let me show you why you should always keep an eye on it...

The No. 1 idea investors must understand about gold and why they need some exposure to it isn't the risks of negative interest rates... or the potential of the Metropolitan Plan... or the madness of our government's runaway deficit spending. It isn't even the likelihood of a complete collapse of the global banking system (which I believe is happening right now).

Sure, those are all important ideas. And I hope you will spend some time learning about gold's long history as the ultimate financial safe haven... But it's not the No. 1 benefit that investors can gain from gold.

What's more important than gold's role as the ultimate financial insurance? As Steve Sjuggerud explained in the April 5 DailyWealth, gold is the ultimate non-correlated asset. That means when the other major asset classes are going down, gold tends to go up.

And yet, you won't find gold anywhere in mainstream brokers' allocation models. And that's a huge mistake. But using a basic asset-allocation model that simply includes gold alongside stocks and bonds can reduce "drawdowns" by more than 50%. Adding bonds and gold into your portfolio allocation can ensure that this never, ever happens to you... while increasing your average returns.

How should you use gold? Let me show you one simple model.

To study the impact of adding gold to investor allocations, we simply back-tested a "dumb" trend-following system. In this model, investors can allocate their portfolios into one of three "pie pieces." They can own stocks (the S&P 500 Index) or bonds (the Merrill Lynch Corporate Bond Index) or gold (just plain bullion). Our model assumes investors will allocate to any of these three assets if they're in an uptrend.

We then measured the results of these assets individually from 1971 (when gold was officially de-linked from the dollar) through 2015. Out of the three assets, stocks did the best, returning 9.9% annually. But these results were very volatile, with drawdowns of 50%. Gold, by itself, did the worst – and also had the worst drawdowns. By themselves, neither gold nor stocks produced satisfactory results. Both produced results that are simply too volatile for most investors to stomach, and gold produced low returns to boot.

Bonds produced the best mix of low volatility and high returns, producing almost as much in gains as stocks, but with far less volatility. (I've often said that most investors should never buy stocks, as they're likely to do better in bonds given their actual risk tolerance, as opposed to their perceived risk tolerance.)

So... is there a better way? Can investors earn more than they would in stocks and have less volatility than they would in bonds? The answer is yes. And in tomorrow's essay, I'll show you exactly how to produce results that dwarf the standard approaches to investing.

Regards,

Porter Stansberry

Further Reading:

Yesterday, Steve told readers that the world's most important number just hit a record low. "The implications are incredible," he says... Many assets are set to soar, including gold. You can read why here.

And earlier this month, Steve shared a simple system for making money in gold stocks that has delivered truly outstanding results. "When this idea is in buy mode, gold stocks return 19.2% annualized gains..." he writes. "And today we're back in buy mode for the first time since 2014." Learn more here.

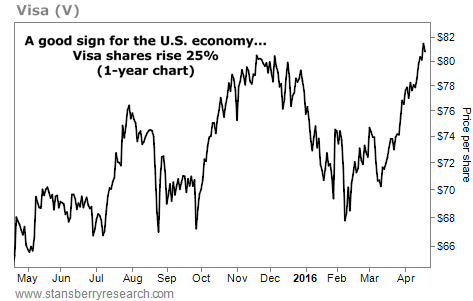

Market NotesAN UPDATE ON THE AMERICAN CONSUMER Today, we point to more good news for the U.S. economy...

Regular readers know we like to keep an eye on businesses that gauge the temperature of the U.S. economy. And while things aren't totally rosy, they aren't as bad as some folks would have you believe. We've recently highlighted this idea with two classic "spending stocks" – ski operator Vail Resorts and pool-supply company Pool Corp. In sum, people are buying things they "want," not just things they "need"...

For more proof that consumers are out spending their money, we turn to the world's largest credit-card company, Visa (V). The company handles more than 100 billion transactions a year, taking a sliver of each one. This makes Visa's profits and share price a "real time" read on the velocity of money and credit.

As you can see below, Visa's business is chugging along. Shares are up 11% in the last month alone... and are now trading at an all-time high. When more people than ever are pulling out their credit cards, things can't be all that bad...

|

Recent Articles

|