| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Best Investors You've Never Heard OfBy

Tuesday, May 17, 2016

Warren Buffett is the best investor of all time... right?

That's the conventional wisdom. But the truth is there are plenty of investors with better track records than Buffett...

For example, have you ever heard of Ed Seykota?

Most people haven't. His name doesn't show up on lists of the world's best investors. But it should...

Seykota is said to have turned $5,000 into $15 million in 12 years in one of his core accounts. That's an extraordinary return of nearly 300,000%.

How did he do it? It was surprisingly simple...

Instead of focusing on fundamentals and earnings reports, Seykota simply follows the trend. He buys what's going up and sells what's going down.

Seykota isn't the only guy with an amazing track record using this approach. Other guys have used the same basic concept to produce extraordinary gains of their own...

You never hear the "pros" talk about these guys. Why is that? I think it's because most pros don't believe such a simple trading idea could possibly work. But how can you dismiss returns like these?

Buffett's approach – finding good companies by digging into fundamentals – feels "smart."

But I have crunched the numbers to figure out what works. Here's what I've learned: You can make money Buffett's way... But you can make more money Seykota's way.

I realize that sounds crazy... Simply following prices shouldn't lead to massive gains. But it does. When you crunch the numbers, you learn that's what works.

Doing just that – following trends – is how Seykota made nearly 300,000%.

I prefer to do what Seykota does. I rarely buy into a downtrend.

I might find an idea through the fundamentals like Buffett. But I almost always wait to buy until the uptrend appears.

I highly recommend that you do the same for one simple reason: It works.

Good investing,

Steve

Further Reading:

"Buy what's working." It's simple... and it can lead to astonishing investment returns. Get the story here: The Simplest Successful Investment System You Can Imagine.

Two months ago, gold fit Steve's three criteria for a perfect investment. It was cheap, hated, and in an uptrend. Read more here: Exactly Why Gold Is Up and Will Keep Going Up.

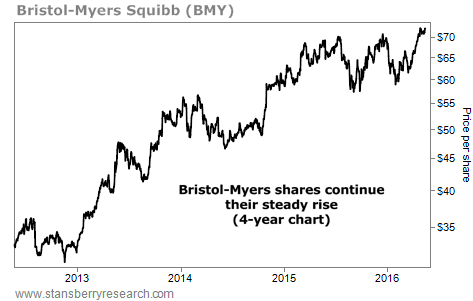

Market NotesTHIS PHARMACEUTICAL GIANT KEEPS MOVING HIGHER Today's chart shows the incredible long-term uptrend in shares of pharmaceutical giant Bristol-Myers Squibb (BMY)...

In October 2014, Porter Stansberry and his research team recommended buying shares, citing the company's cutting-edge cancer treatments as a catalyst for future growth. While traditional chemotherapy causes painful side effects in patients, Bristol-Myers' cancer drugs target the immune system and train it to fight the cancer.

The company continues to stay one step ahead of its competition. Recently, one of its cancer drugs proved to be an unprecedented cure for Hodgkin lymphoma.

As you can see from the following chart, shareholders are being rewarded for it. Bristol-Myers shares have climbed nearly 50% since Porter's original recommendation. Shares now trade at levels not seen since the early 2000s. And the future looks bright as Bristol-Myers continues to find new ways to fight cancer.

|

Recent Articles

|