| Home | About Us | Resources | Archive | Free Reports | Market Window |

The No. 1 Thing I Want From an InvestmentBy

Wednesday, September 21, 2016

Some people like to invest in stocks. Some people like to invest in real estate. Some people like to trade commodities...

But all I want is an investment that goes up every year, regardless of what's going on in the stock market.

Regular DailyWealth readers know we call these businesses World Dominating Dividend Growers (or "WDDGs"). WDDGs are often the No. 1 or No. 2 companies in their industries. And they have a history of rewarding shareholders with growing dividends.

Let me show you what I mean...

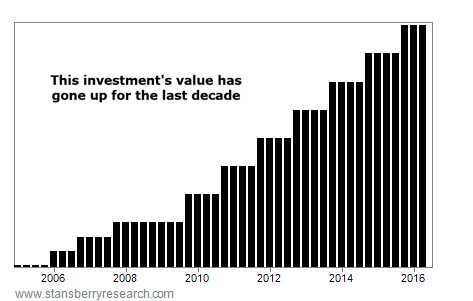

What you want is a chart that looks like this:

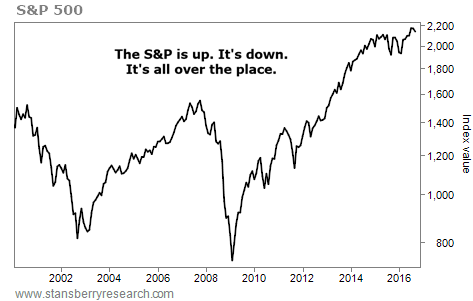

No, that's not a share-price graph. It's a picture of larger and larger amounts of cash placed directly into shareholders' pockets by a business that has paid higher and higher dividends each year. Let's compare that WDDG graph with a chart of the S&P 500 from 2000 through 2016.

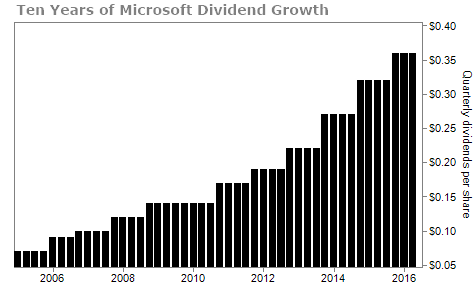

It's important to understand that you cannot safely rely on the stock market's action as a source of investment return. No share prices march straight up forever. But everyone can invest in businesses with a history of consistently rising dividends. That's why investors who want to make consistent returns from stocks need to focus on dividends... and relentless dividend-growers like WDDGs. Now, investors love dividend stocks these days. That drives up their prices a bit. The best WDDGs don't always have very high current yields. Microsoft (MSFT), for example, is a WDDG – the one from our first chart. It yields around 2.8%. That's not very impressive when compared with some of the other dividend-paying stocks out there.

But real income growth – the type that always goes up – can be achieved by reinvesting those dividends.

Let's take a look at Microsoft to see just what reinvesting in shares with a growing dividend can do...

Microsoft started paying a dividend in 2003. Since then, it has grown the dividend every year (except for a small drop in the crisis year of 2009 – and it came back stronger than ever). For the last five years, Microsoft has increased its dividend by nearly 19% a year... And I see no reason for growth to slow down.

Microsoft has a decent current yield. But you can build that into a much-better-paying retirement nest egg...

For example, say you buy 100 shares at $50 per share. Total cost: $5,000. The stock yields about 2.8%, and the dividend has been growing at 19% a year, so let's be conservative and assume that slows a bit to 10%.

At the end of the first year, you'll receive $140 in dividends ($5,000 x 2.8%). Since Microsoft raises its dividend 10% in Year 2, you'll earn $154 in dividends.

Repeat this process for 10 years, and you'll make $363.12 in dividends in the 10th year. That's a 7.3% dividend yield off your initial $5,000 investment... or a 7.3% "yield on cost."

So with Microsoft, you'll be earning 7.3% over your cost within 10 years... And in 20 years, you'll be earning an astounding 18.8% over your original cost.

Even so, you can earn more. The yield above is what you'd get if you took the dividends as cash for spending. Instead, when you plow them back in, buying extra shares through reinvestment, you'll earn an even higher rate of return. Take a look...

Let's assume you buy 100 shares at $50 each and reinvest all of your dividends. Assuming 10% annual dividend growth and 5% annual share-price growth, you could turn an initial investment of $5,000 into more than $35,000 in just 20 years...

A rising dividend payout is one of the strongest ways to build wealth in finance... But as you can see, sitting back and letting your reinvested dividends earn their own dividends grows your investment dramatically. Get started today, and you'll tap into an incredible income stream that rarely goes down.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

In August, Doc shared a "cheat sheet" to finding the world's best dividend-paying stocks. "All it takes is the single click of a mouse," he explains. Learn more here.

Last month, Doc shared several of his other favorite income investments... like preferred stocks, REITs, selling put options, and closed-end funds.

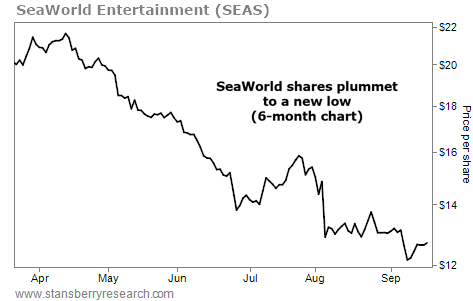

Market NotesTHE BIG LONG-TERM DOWNTREND IN THIS ENTERTAINMENT GIANT Today's chart highlights the trouble that has struck a popular theme-park operator...

SeaWorld Entertainment (SEAS) owns 11 theme parks across the U.S. – including its namesake locations in Orlando, Florida, San Diego, California, and San Antonio, Texas. In total, SeaWorld parks welcomed more than 22 million people through their gates in 2014.

But the business has run into some hard times in recent years. The 2013 movie Blackfish chronicled the history of killer whales in captivity. It added to the growing backlash from animal-rights groups about the way SeaWorld treats its animals. And in August, the company reported that attendance dropped by nearly 500,000 guests in the second quarter alone.

With all of this negative news, SEAS shares plunged to an all-time low earlier this month. They're down nearly 70% from their July 2013 high... and more than 40% since this past April. Unless SeaWorld is able to turn things around soon, shares appear to be stuck in a downtrend for the foreseeable future.

|

Recent Articles

|