| Home | About Us | Resources | Archive | Free Reports | Market Window |

How to Trade Like You Have a Sixth SenseBy

Friday, October 7, 2016

Don't fall for these headlines...

The New York Times recently reported that "trust your gut" could be profitable advice on Wall Street... while the Financial Times described "gut feelings" as key to financial trading success.

Successful high-frequency traders may have a sort of "sixth sense" that they use to take in information and make snap decisions. For a certain group of investors, "trust your gut" may make them money.

However, the vast majority of us don't have this sixth sense. Instead, most people make terrible investing decisions when they listen to their "gut"...

The biggest trap we fall into is something called "loss aversion."

My friend Dr. Sue is a good example of this. Instead of cutting her losses early, Sue watched as her entire portfolio tanked. She was so afraid to make a mistake that she just kept watching her losses get bigger and bigger.

Her story highlights one of the most common mistakes (and among the hardest lessons to learn) of investing.

Loss aversion is a well-known phenomenon. It has been studied and reported on in financial and economic literature. Yet it trips up educated and ignorant people alike. It's very human. And if you're not aware of it, you'll lose thousands of dollars before you know it.

Loss aversion goes hand in hand with something else called the "disposition effect."

The disposition effect basically means that people hate losing far more than they like winning. It's the basic principle behind why people can lose their shorts in Vegas – they're more likely to take a gamble when they've been losing.

Sue was gambling with her portfolio, in a sense. Instead of cutting her losses, she kept "gambling" on the chance they would bounce back. So her losses kept adding up.

This kind of behavior stems from fear – fear of losing money and of making mistakes. And fear comes from a tiny part of our brains called the amygdala.

Here's my secret: You don't need a sixth sense to figure out how to be a good trader. You just need to follow three simple steps...

Your amygdala senses threats, and your brain releases chemicals that trigger the "fight or flight" response... You get sick to your stomach, your pupils dilate, and you want to run and hide. Learning to calm your amygdala helps you evaluate things more logically, without falling prey to fear. Meditation is my favorite way to reduce the activity in the brain's amygdala. The amygdala is also a contributor to anxiety disorders and stress. Quieting this region of the brain bolsters more positive feelings.

A study from the National Bureau of Economic Research discovered that traders with happier, more positive moods (and thus quieter amygdalae) had better performances in their portfolios.

You need stop losses to best protect your investments. They take all the emotion out of your choices – instead, when your stock hits a stop, you sell. No questions or hesitations. There are two types of stop losses: hard stops and trailing stops.

Hard stops use a set price or percentage below the purchase price. If the stock falls to that amount at any time, you sell. Trailing stops use a percentage below the purchase price, but they don't stay the same. As the price rises, the trailing stop follows it.

Asset allocation is how you divvy up your capital among several categories of assets. Changes in the market get smoothed out by the diversified nature of your portfolio... leaving you to sleep well at night. The key is doing it from the start and sticking to it.

First, you should set aside some cash for emergencies... Then, start with a simple allocation: Decide between stocks and bonds. When someone is starting off, I suggest using a "middle of the fairway" asset-allocation plan: 60% stocks and 40% bonds. It ensures you will harness the proven wealth-building power of stocks... while also using the conservative, income-producing power of bonds.

The key is to find a balance that best suits your risk tolerance. And remember, don't sink all of your 401(k) into one company or one sector – if it drops, you'll lose everything.

You might never develop that sixth sense for investing. But if you follow these three steps, you'll be well on your way to becoming a successful trader.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

"Some people like to invest in stocks. Some people like to invest in real estate. Some people like to trade commodities," Doc writes. "But all I want is an investment that goes up every year, regardless of what's going on in the stock market." Get the full story here: The No. 1 Thing I Want From an Investment.

Earlier this week, Kim Iskyan shared a few easy ways to protect your portfolio. Catch up on them here: Three Simple Rules to Improve Your Investment Results.

Market NotesTHE LATEST WINNER IN THIS BELOVED STRATEGY Today, we're highlighting one of our favorite investment strategies in action...

Regular readers know we're big fans of "trophy assets." These are the world's highest-quality, one-of-a-kind assets... like the best copper mines, the best steel mills, the best real estate, and more. In the past, we've discussed why Facebook's social network is a trophy asset.

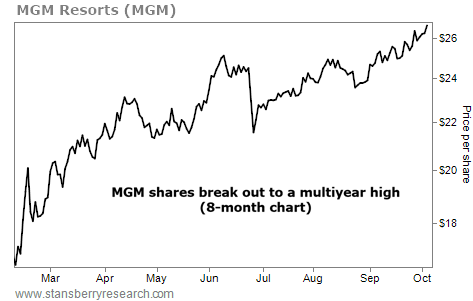

Another one of our favorite trophy-asset companies is casino operator MGM Resorts (MGM). The $15 billion gambling giant owns the most luxurious, first-class resorts and casinos along the Las Vegas Strip and around the world. In December, MGM Resorts plans to open its newest location – the $1.4 billion MGM National Harbor in the Washington, D.C. area.

As you can see in the chart below, MGM shares have taken off since the beginning of the year. They're up more than 60% from their February low... and just reached their highest level since mid-2014. From social networks to five-star hotels, it pays to invest in the companies that own these unique assets...

|

Recent Articles

|