| Home | About Us | Resources | Archive | Free Reports | Market Window |

Copper Has 40%-Plus Upside... Starting NowBy

Thursday, November 17, 2016

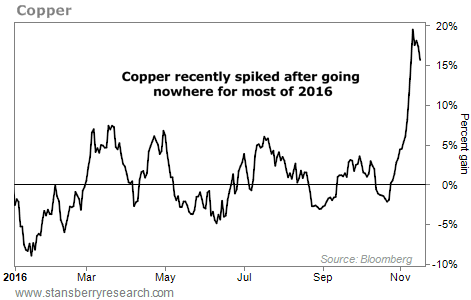

Copper just finished one of its largest short-term spikes ever...

The metal is up 18% since late October. And it soared more than 9% in just three days last week.

That has only happened a handful times since 2000. Based on that history, gains of 40%-plus are possible over the next year.

Let me explain...

Gold and silver got the headlines for most of 2016. And for good reason... Both metals have performed well this year.

That hasn't been the case with copper. At least, not until recently.

The metal has moved sideways for much of 2016. But over the past few weeks, it has staged a massive breakout. Take a look...

Copper went nowhere for the first 10 months of the year. Now, the metal is up 18% since October 25... and most of those gains came in a flurry last week. This kind of 9%-plus gain in three days is rare. It has only happened 17 other times since 2000. But history says these extremes tend to happen at the beginning of a major move higher.

The numbers here are a bit crazy. Copper doesn't just outperform after these extremes... It absolutely soars. Take a look...

Simply buying copper would have led to 3.3% six-month gains and 6.7% single-year gains since 2000. But buying after these extremes led to results that were more than six times better... These 17 extremes led to typical returns of 14.3% in three months... 24.8% in six months... and an incredible 41.9% over the next year.

Even more impressive is that 15 out of the 17 previous extremes led to a positive return over the next year. So copper almost always moves higher a year after these quick spikes.

You could trade this extreme by buying the metal. But we prefer to buy the companies that produce the copper instead...

We own the iShares MSCI Global Metals & Mining Producers Fund (PICK) in our True Wealth newsletter. Shares of PICK are up more than 30% since July... But it's still early in this trade. The shares are still down 50% from their 2012 levels.

Copper – and PICK – deserve a serious look today.

Good investing,

Brett Eversole

Further Reading:

"The carnage in precious metals investments has been terrible," Steve wrote last month. "The question is, has it been terrible enough?" Learn how to spot the next short-term buying opportunity in gold here: Gold Isn't a Buy Yet... But It's Close.

"The downtrend might be nearing its end," Steve wrote. Just two weeks later, precious metals staged a major move. Find out what it means for gold... and which metal is even closer to a buy right now: A Massive Change in Precious Metals You Need to See.

Market NotesA SMALL CORNER OF THE MARKET IS SURGING Today's chart highlights one of this week's strongest performers...

The shipping sector is surging... To understand why, we need to look at the Baltic Dry Index ("BDI"), which is used to measure the price of moving major raw materials by sea. The BDI is calculated by looking at shipping prices on four types of dry-bulk carriers, which carry a range of commodities... including coal, grain, and iron ore.

As demand for these commodities grows, shipping companies charge more for their vessels, and the BDI rises. The BDI has increased for nine straight days and is at a new 15-month high.

One of the big beneficiaries of a rising BDI has been Diana Containerships (DCIX). The microcap global shipping and transportation company owns and operates a dozen container vessels. Over the past few days, shares spiked more than 500%. If the BDI continues to rise, DCIX shares will continue to soar...

|

Recent Articles

|