| Home | About Us | Resources | Archive | Free Reports | Market Window |

When the Crash Comes, Will You Be Ready?By

Wednesday, November 30, 2016

Prem Watsa stood at the podium and delivered the most prescient warning the crowd would hear...

It was April 2007, just six months before the S&P 500 hit its peak. Watsa reminded the audience at the Richard Ivey School of Business what really happens when a specific trade gets too hot... Generally, that trade collapses. And he was right.

Two years later, just a few months after the market bottomed in mid-2009... Watsa had booked a 489% profit from a bet on the great recession... Essentially, he'd gone short on real estate. It was a $2.1 billion payday.

It wasn't his first correct call on a bubble... nor the first time he'd profited massively. But it was probably his biggest success.

Today, we're going to show you how Watsa pulled off one of the most profitable bets we've ever seen... and how we can do the same thing...

As early as 2005, Watsa was targeting big American banks and bond insurers exposed to the housing boom.

He had been buying large amounts of credit default swaps (CDSs). These swaps are effectively insurance. The buyer (Watsa, in this case) pays to transfer the risk of default for a bond to someone else... who provides "insurance" against a default. Then, when the underlying security suffers a default, the CDS buyer profits.

At one point in 2006, Watsa was down $87 million on his position – or 74%. But he knew the crisis was just around the corner. So he kept buying.

When the global financial crisis hit in 2008, Bear Stearns, Lehman Brothers, and AIG all failed. Within the year, the $433 million bet Watsa had placed was worth more than $2.5 billion... He made $2.1 billion on the deal – almost five times his original investment.

Watsa saw the bubble forming and knew that it must eventually collapse. So he made his bet by buying insurance on the companies he knew would suffer the most.

And that's exactly what we aim to do...

First, and most important, we also see a storm coming – only this one will be far more damaging than the credit crisis in 2008-2009.

If you've read any of our recent essays on the looming crisis (you can find them here, here, and here), then you know... We're seven years into a bull market... one that has been driven by artificially low interest rates and debt. Corporate debt issuance has grown over the past five years at a pace we've never experienced before. More than $9.5 trillion in global corporate debt is coming due over the next five years. About $1.6 trillion of that debt is below investment grade, or "junk."

Yet the market is pricing little risk into the equities that hold it. The market's "fear gauge" – the Volatility Index (or "VIX") – remains near near-record lows. No one is paying attention.

It won't last. It never does.

This credit cycle is nearing an end. When it finally rolls over, many investors holding the shares of weaker credits – aka "junk" rated companies – are going to see the value of their stocks plummet. Some will go to zero.

Here's where the second important point of Watsa's story comes in: Instead of simply shorting stocks, he used CDSs to take the trade even further. He wasn't just betting that these companies would go down... He was betting that they wouldn't be able to pay their debts at all.

We think the same thing will happen this time. And we plan to profit in a similar way.

We've identified key sectors that face many of the problems that we saw back in 2007... These sectors have increasing debts and a wall of maturities coming due.

We've also compiled a list of 30 names from that universe of distressed companies into what we call "The Dirty Thirty."

The only difference between Watsa's strategy and ours is the instrument we'll use. We want to protect our portfolios and speculate on the pending collapse. But it's not easy for small retail investors to buy CDSs. So instead, we're using long-dated put options. The mechanics are different. But the outcome will be the same.

Don't let the idea of trading options intimidate you. Put options are simply contracts you hold with your broker that allow you to sell a stock at a specified price at a specified time. And we've created our new service, Stansberry's Big Trade, to walk you through each trade step by step.

Like Watsa, we stand to make huge 500% gains. But remember... like he did, we could also face some stress in our positions. These are speculations, not safe bets to buy and hold forever. That's why we'll exercise patience and build out a diversified portfolio over the next 12-36 months. These factors are critical to our success with this strategy.

Investors remain complacent about the underlying problems in the credit markets today... just like in 2007. No one listened to Watsa when he said the collapse was coming. They believed that the results would be different.

Our bet is that this time, nothing's changed. And this is our chance to set ourselves up for massive profits.

Regards,

Porter Stansberry

Further Reading:

Over the last month, Porter has warned DailyWealth readers of the upcoming dangers in the market. Catch up here...

Market NotesTHE LATEST 'PICKS AND SHOVELS' WINNER They're the driving force behind our electronics... And they power everything from flat-panel TVs to cell phones.

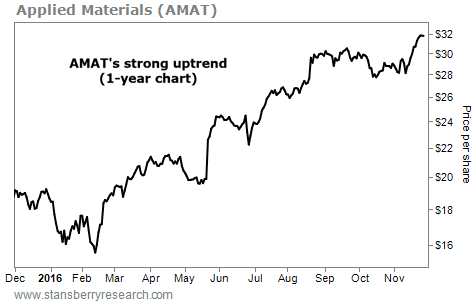

We're talking about semiconductors, the little engines that process huge amounts of information in our electronics. Today's chart highlights a behind-the-scenes company that simplifies manufacturing these critical parts.

Regular readers know one of our favorite ways to profit off any trend is through "picks and shovels." These are the companies that provide the tools, products, and services vital to the success of long-term trends, rather than betting the whole company's future on a single product. You can see this concept at work with Applied Materials (AMAT). The $34 billion company provides the software and equipment necessary to manufacture semiconductors.

As you can see below, shares of Applied Materials have soared over the past year, recently hitting a new 52-week high. As electronics consume more and more of our daily lives, Applied Materials' business should continue to thrive...

|

Recent Articles

|