| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

The Weekend Edition is pulled from the daily Stansberry Digest. The Digest comes free with a subscription to any of our premium products.

Watch for This 'All Clear' Signal Before Buying Gold StocksBy

Saturday, April 22, 2017

So says our colleague Ben Morris about a potential breakout in precious metals.

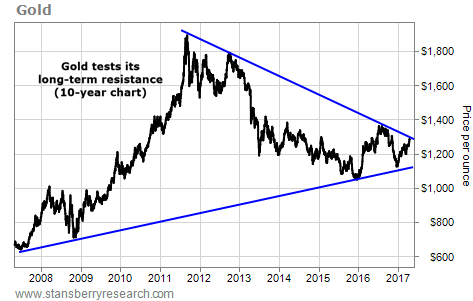

Ben recently noted that both gold and silver, as well as their related mining stocks, had reached critical "resistance" levels. Gold, gold stocks, and silver stocks were still testing these levels, while silver had just broken through.

He said that gold, in particular, faced a major test on its long-term chart. As we shared in the April 12 Digest...

This is a bullish sign. But Ben says the final – and most important – test remains. As he explained in DailyWealth Trader this week...

As he noted, if you've been holding bullish trades in gold, gold stocks, silver, or silver stocks, you've likely had a good couple of weeks. But these assets all tend to follow gold. So he still doesn't recommend placing new trades today, until gold finally breaks out on its long-term chart, too...

That is, folks who are interested in speculating on higher gold and silver prices. It doesn't apply to your "core" positions in physical gold and silver.

As longtime readers know, we look at these core positions as a form of savings, as well as crisis "insurance" that you buy and hope you never need.

If you still don't have a small portion of your savings in physical gold and silver, it's never a bad time to buy. But if you have these bases covered, Ben suggests waiting to buy more...

Palm Beach Letter editor and former hedge-fund manager Teeka Tiwari knows more about Bitcoin and other so-called "cryptocurrencies" than anyone we know.

Over the past year, he has traveled more than 30,000 miles – to places like London, Berlin, New York, and Las Vegas – to meet with Bitcoin millionaires, venture capitalists, and high-level industry insiders.

His purpose? To develop a way to identify fast-moving cryptocurrencies before they soar.

Teeka recently explained his four-part strategy – what he calls the "BITS system" – and said that it just flashed a "buy" signal in a little-known cryptocurrency play.

Right now, this idea trades for around $3.50. But based on Teeka's system, he believes it could soar to $13 soon. That's a gain of more than 250% in a matter of months.

And that's just the low end, according to Teeka. On the high end, he believes you could eventually be looking at 10, 20, or even 25 times your money.

For a limited time, you can find out more about Teeka's new system – as well as all the details about how you can invest in this cryptocurrency today. Click here for details.

As you may know, BlackRock has been the world's largest asset manager for nearly a decade. It dominates Wall Street.

In fact, founder and CEO Larry Fink was recently asked if he was the most powerful man on Wall Street. His only quibble was that BlackRock's offices are in Midtown.

But we don't bring this up to discuss the firm's earnings...

You see, alongside its latest results, BlackRock reported an astonishing achievement, even by its standards. It noted assets under management have now soared to a record of $5.4 trillion.

We hear a lot of big numbers tossed around these days... $1 million – or even $1 billion – isn't as impressive as it used to be.

But $1 trillion is still an unfathomably large number for most folks. Consider this: 1 million seconds is equal to about 12 days. But 1 trillion seconds is more than 31,000 years.

In large part, by leading a trend that is radically changing the investment world.

Many folks don't pick stocks anymore. More and more, they prefer to collect the average market return (less fees) by buying index funds. And BlackRock has become a leader in low-cost index funds and exchange-traded funds (ETFs).

BlackRock runs some actively managed funds, but it owes its growth to the rise of "indexing."

This trend has been celebrated by many in the financial media. And for many folks, investing in index funds is an improvement over high-cost mutual funds that rarely beat the market. But you likely haven't heard about one of the biggest risks to index investing.

In short, the size – and quality – of the stock market has been quietly declining...

In 1996, the U.S. stock market boasted more than 8,000 publicly listed companies. Today, that number has fallen to just 3,600.

Thousands of firms have "disappeared" via private buyouts and mergers. And they're no longer being replaced by as many new ones.

Today, innovative startups are staying private longer... or no longer going public at all. Instead, these firms take money from wealthy investors in markets that aren't available to regular investors.

It's lowering the quality – and therefore, the potential return – of the broad market, too.

After all, do you think these institutions and skilled investors choose the worst investments for themselves? Of course not.

They buy the most profitable businesses and best investments, take them private, and keep them out of the hands of everyday, public investors.

Over time, this leaves investors in index funds holding the "junk" that private money doesn't want. And fewer quality businesses means lower market returns.

First, stay with us...

Of course, we're biased. But we believe our investment research is among the best available anywhere... at any price. And high-quality research will become more and more important for individual investors as the universe of great companies continues to shrink.

Second, we recommend taking advantage of opportunities to shift these trends in your favor...

For example, our colleague Dr. David "Doc" Eifrig has identified a simple "backdoor" way to partner with some of the best private-equity investors in the world.

Doc says folks who take advantage of this opportunity could see capital gains of 150% or more in the years ahead... And they'll collect an income stream that's three times higher than average publicly traded S&P 500 companies while they wait.

But unlike most private-equity investments, you don't need connections or millions of dollars in capital to take advantage. Any regular investor can participate.

This week, Doc published all the details on this opportunity. It's not too late to get involved, but you need to act soon. To learn more, click here.

Regards,

Justin Brill

|

Recent Articles

|