| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today, we're sharing an essay from a new addition to the Stansberry team, longtime oil-industry titan Flavious Smith. Some of you may have seen this piece in our latest weekend edition of the Stansberry Digest. However, this prediction is so momentous that we felt it deserved a wider audience.

You see, despite the glut of supply keeping oil prices down, Flavious is bullish. Here's why he expects oil to soar spectacularly over the long term...

Despite the Headwinds, Oil Prices Are Heading Much, Much HigherBy

Tuesday, June 13, 2017

"Boy, you can't score a touchdown if you're not in the game."

My grandfather must have told me that a hundred times growing up. It was good advice for the gridiron. But as a kid, I never imagined it would apply to my career in the oil business.

But it turns out grandpa's advice was useful beyond my playing days. As resource investors, we must always be looking for value. We can't wait for good things to happen... because by then, the big opportunities will be gone.

Oil prices will move higher soon. And that's why you want to be in the game now...

Today, you turn on the TV and hear nothing but bad news in the oil industry. Oil prices are down and going lower. Reports estimate that the U.S. has lost 200,000 oil and gas jobs since mid-2014.

There is some hope. Investment bank Goldman Sachs says half of those jobs might return by 2018. But I'm not sure where you'll find the talent. Most of those folks have left to work construction or at the local car lot.

As prices fell to as low as $27 a barrel last year, revenues dropped, and debt crushed many companies. A wave of bankruptcies swept across the industry.

According to bankruptcy-law firm Haynes and Boone, 114 exploration and production ("E&P") companies declared bankruptcy from January 2015 through last December. The combined debt for these companies totaled more than $74.2 billion. Over the same period, 110 oilfield-services companies went belly up... with total debt of more than $18.8 billion.

That's 224 bankruptcies and $93 billion in debt.

But we're just getting started... We'll see another massive wave of bankruptcies before the oil and gas sector emerges from this ongoing bear market. The continued drilling and near-record production will keep driving oil prices lower. The companies with higher costs and big debt loads will become the next victims.

Two months ago, I attended the Oil & Gas Investment Symposium in New York. More than 70% of the companies presenting had debt levels that exceeded their market caps. Things won't end well for these companies.

Today, oil trades around $45 a barrel. But as long as oil stays below $50 a barrel, almost every oil play in the U.S. is uneconomic. Low oil prices are killing entire economies. The cost of getting a barrel of oil out of the ground in Russia is about $70. In Iran, it's in the mid-$60s. In the North Sea around Western Europe, it's $55.

With a few exceptions, the Saudis – whose production costs sit around $25 per barrel – are in the catbird seat.

Meanwhile, global oil production is about 98.5 million barrels per day, while demand is about 97 million barrels.

And yet... despite all of these headwinds, I'm bullish on oil prices. You see, in the next few years, oil demand is going to absolutely skyrocket.

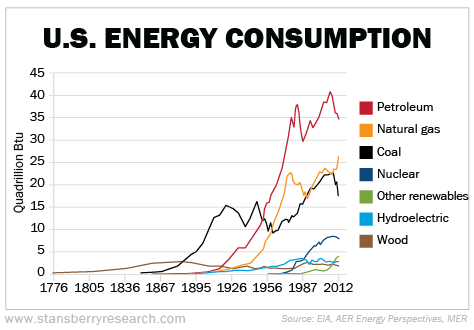

Today, the U.S. is the largest consumer of oil on the planet. We use about 7.2 billion barrels per year, or nearly 20 million barrels per day...

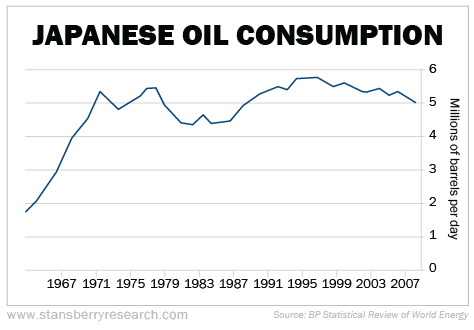

Meanwhile, our friends in Japan use nearly 5 million barrels of oil per day, or around 1.8 billion barrels per year...  Both countries have a high standard of living and industrialized economies. We make a lot of "stuff," we drive a lot of cars, we watch a lot of TV, and we use a lot of air conditioning. So it's no surprise that we use a lot of oil. But as I'll explain in tomorrow's essay, this is a drop in the bucket compared with the demand we'll see going forward. Some of the world's emerging powers have the potential to kick this demand into high gear. Stay tuned...

Good investing,

Flavious Smith

Further Reading:

The important thing to know about investing in resources like oil is that they're incredibly cyclical. And as resource guru Rick Rule explains in this classic interview, if you catch one of these upcycles early, you may never have to work again. Read more here: Mastering the Resource Market's Cyclicality.

A different class of commodity stocks has been falling recently. Investors are finally throwing in the towel... And that means a great opportunity could be around the corner. "The lowest-risk time to buy is typically when even the hardiest investors in an asset have given up," Steve explains. Learn more here.

Market NotesA SURPRISING PURCHASE FROM A LEGENDARY INVESTOR Today's chart highlights a big change from a legendary investor...

Warren Buffett is widely considered one of the greatest investors of all time. He has assembled a legendary portfolio of both private and public companies to form his $420 billion investment company, Berkshire Hathaway. Since its inception, the firm has brought in about 18% returns annually for Buffett's clients.

But even Buffett has struggled in certain industries... Take airlines, for example. Buffett used to have a strict "no airlines" rule. And he has joked about calling a hotline to "talk him down" before he bought any airline stock. So it's surprising to see that he recently invested about 6% of Berkshire Hathaway's stock portfolio (about $9 billion) in airlines.

One of his top airline holdings is Delta Air Lines (DAL). Delta's latest earnings report was optimistic, with double-digit operating margins and improved customer satisfaction. As you can see, Delta's shares are up more than 25% in the past year... and recently hit a new all-time high. The airline business is known for its big "boom and bust" cycles. But with Buffett on board, it could be "boom" time for the airlines...

_IPK1RAX9KP.png) |

Recent Articles

|