| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Most Important Trend in Finance That No One's WatchingBy

Tuesday, August 1, 2017

Did you see it happen?

Have you noticed the most important trend in finance this year?

Most folks haven't. They have no idea what's going on...

They completely missed this enormous shift. They have no idea that for the first time in years, the U.S. dollar is crashing.

This is an enormous change from the past few years. And history tells us that the losses will likely continue...

The U.S. dollar was a major story in recent years. The rally in the U.S. dollar, that is.

The buck rose 40%-plus from early 2011 to the end of 2016. It was a massive uptrend with huge implications for the global economy. But 2017 has seen a huge reversal.

The first six months of 2017 was the worst six-month stretch for the dollar since 2011.

The dollar is down more than 8% in total in 2017. That's a huge move for the world's reserve currency. And it led to something we haven't seen in a while...

On July 21, the U.S. dollar hit a new 52-week low. That's the first 52-week low we've seen in the dollar in more than a year.

The dollar bull market has major chinks in its armor. You can see this clearly in the chart below. Take a look...

The chart shows the U.S. Dollar Index, which compares the dollar's value with a basket of other currencies. And as you can see, a new downtrend appears to be in place. That doesn't mean we'll see an additional 20% decline all the way down to 2011 levels. But history says further losses are likely.

Specifically, the dollar tends to keep falling after hitting a new 52-week low. The table below shows the returns...

The table shows data going back to 1967. The dollar is down 22% since then, so the currency has a slightly downward bias. Still, the declines tend to be much worse after 52-week lows. After new 52-week lows, the dollar has fallen 1.3% in six months, 2.9% over the next year, and 4.8% over the next two years.

Those aren't massive downside numbers. But currencies tend to move slowly. The dollar is already down more than 8% from its recent high... Another 5% decline would solidify a significant downtrend.

No one has been talking about this major shift. But movement in the dollar has huge implications...

It affects overseas investments, U.S. companies with international sales, and prices of commodities, for starters.

Now, a falling dollar isn't explicitly good or bad for stocks. But we're seeing a major shift in the dollar. The long-term trend could be reversing.

That makes this a shift you'll want to track closely in the coming months.

Good investing,

Brett Eversole

Further Reading:

Yesterday, Brett shared another extreme with DailyWealth readers. As he explained, this rare market event suggests stocks could rise 15% over the next three months. Get the full story here.

While the dollar is suffering, U.S. real estate is in a bull market. Last week, Steve explained an easy "one click" way to take advantage. Learn more here.

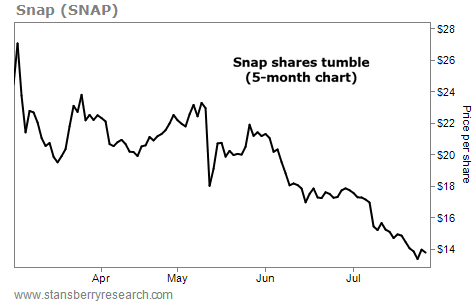

Market NotesWHAT HAPPENS WHEN A TRENDY STOCK GOES WRONG Today's chart is an important reminder why you don't buy "cocktail party" stocks...

If you find yourself at a party where everyone is talking about the same company, it's time to be cautious. Because when everybody at the party owns the same stock, chances are good that nobody is left to buy...

An excellent example of this is social-media stock Snap (SNAP). The company makes the popular Snapchat smartphone app, which allows users to send temporary photos and videos to friends. The stock went public in March at around $17 a share. It quickly soared above $27 as investors bought into the hype. But the company is spending cash faster than it can make it...

Last year, Snap lost $677 million, more than two times what it lost in 2015. The stock is already down nearly 50% from its previous highs and hit another new low last week. Let Snap's downtrend serve as a reminder the next time you're at a cocktail party and someone gives you a "hot stock tip"...

|

Recent Articles

|