| Home | About Us | Resources | Archive | Free Reports | Market Window |

The First Threat to My 'Melt Up' Thesis Is HereBy

Tuesday, November 14, 2017

A few months ago, I published five warning signs for the end of the "Melt Up" for paid subscribers to my True Wealth Systems letter...

At the time, NONE of them were worth worrying about... The five indicators were "all clear."

But today, at least one of them is not.

I will share this indicator with you today. And I'll tell you what it means right now...

These five indicators are powerful...

Before stocks crashed in 2000 and 2007, all five of these early warning indicators were flashing RED. Those were the only times in the last quarter century that all five indicators flashed RED together.

But keep in mind, these five signs are "early warning" indicators...

They DO NOT mean the end is here. Instead, when ALL FIVE are flashing RED, risk is extremely high. These signals typically warn us months in advance of the overall stock market peak... like they did in 2000 and 2007.

While it's not fair to my paid subscribers to share all five of these indicators with you, I will share one of them today.

It's a specific move in transportation stocks...

You probably know that the overall stock market peaked in 2000. But you probably don't know that transportation stocks peaked in May 1999 – long before the overall market did.

The same thing happened in 2007. The overall market peaked in October 2007. But transportation stocks peaked months earlier, in July.

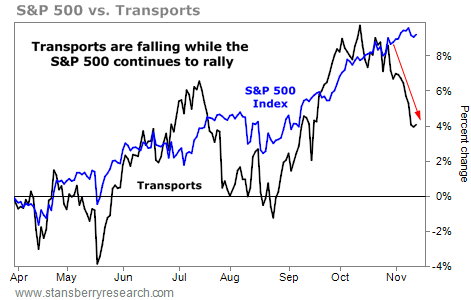

Today, we're seeing the first signs of underperformance in transports... Take a look:

Just like we saw in 2000 and 2007, the overall stock market hit a new high, but the transports didn't "confirm" it with a new high of their own. Why are transports a leading indicator?

One possible explanation is that transportation stocks thrive when the economy is strong and goods are moving around. When the economy weakens, those goods stop moving, and transports are one of the first places it shows. So they tend to peak before the overall market.

While underperformance in transports is a good early warning sign, it's not a sell signal...

First, this is just one of the five indicators. Secondly, transports could still turn around and hit new highs, wiping out this short-term concern. And lastly, the overall market has typically peaked months after this early warning signal flashed.

In short, this is not the end of the final Melt Up stage of this bull market. This is just one early warning sign that could be starting now.

It's my job to keep you in the Melt Up as long as possible. You might think that means I need to be the biggest cheerleader for the Melt Up. But I look at it a different way...

I think my job today is to help you maximize your gains – and let you know when it's finally time to pull the plug.

I'm on it...

Good investing,

Steve

Further Reading:

"Markets do not go up indefinitely," Steve says. The economy recently flashed another surprising warning. Learn more here: A Major Ominous Sign for Stocks.

"What should you do to participate in the Melt Up – and limit your downside risk in the Melt Down?" Steve writes. Read his essay to learn from the last great tech-stock boom – and crash – right here: 'We Expect Over 100% Gains per Year.'

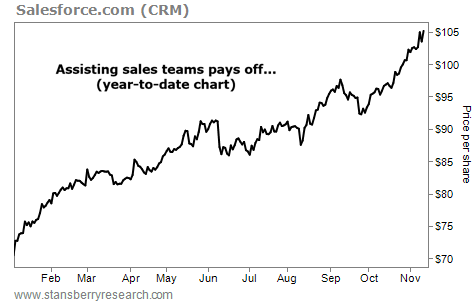

Market NotesBUSINESS IS EASIER WITH THIS SOFTWARE LEADER Today's chart highlights the company behind a leading sales-management system...

Regular readers know one of our favorite ways to invest is through "picks and shovels." These companies provide the tools, products, and services that support broad industries and long-term trends. We can see this idea at work today with software titan Salesforce.com (CRM)...

This $76 billion tech giant provides its clients with customer-relationship management software. As companies get bigger, it gets harder for them to keep track of their customers. Using Salesforce.com's platform, sales agents can upload meeting notes, bids, or even a customer's favorite restaurant to a customer account. And since it's all stored in the cloud, they can access it anywhere, anytime. In short, this is a business that helps people do business... And with fourth-quarter revenues up 27% year over year, it's showing incredible growth.

As you can see, Salesforce.com is soaring this year. Shares are up nearly 55% since January, and they just hit a new all-time high. As more businesses turn to this company to boost their sales teams' productivity, its shares will continue to rise...

|

Recent Articles

|