| Home | About Us | Resources | Archive | Free Reports | Market Window |

Four Ways to Protect Your Portfolio From a CrashBy

Friday, April 15, 2016

There is a tremendous amount of uncertainty in the world at the moment. We are in uncharted waters everywhere we look. We're seeing a breakdown of trust across the board.

People don't trust their leaders... countries don't trust each other... banks don't trust their clients... clients don't trust their banks... businesses don't trust their governments and vice versa, etc.

In such a toxic environment of mistrust, it doesn't take much for things to quickly spiral out of control. The same is true for financial markets.

This absence of trust has me worried about the current environment today. We can't keep heading down the road we're on. It's time to be prepared for a sudden and shocking storm... and hope that it never arrives. The good news is, it's not that hard to prepare your portfolio for a possible storm...

No one has been more concerned about the possibility of a coming storm than Stansberry Research founder Porter Stansberry. For the past six months, he has taken every possible opportunity to warn his readers in no uncertain terms that he believes we are on the verge of a massive crisis.

In his Stansberry's Investment Advisory newsletter, he has acted accordingly and has taken action to hedge his portfolio. He has been proactive about reducing the risk in his portfolio. And as you'll see, his portfolio has held up during the market volatility we've seen over the past six months.

His short positions (which rise as the market falls) cushioned his returns during the recent market declines. Let's take a look.

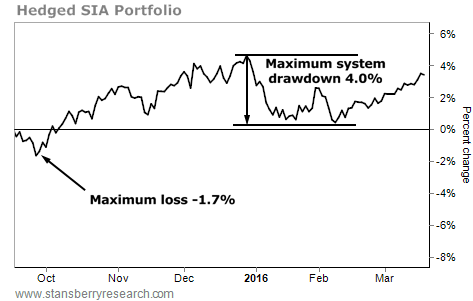

The following chart shows the performance of Porter's portfolio (using an equal-weighted index approach) over the last six months.

In spite of the significant market volatility we've seen, the hedged Stansberry's Investment Advisory portfolio has been surprisingly calm. It dipped just 1.7% below the zero line back in September 2015. From late December to early February, the drawdown from peak to trough was just 4%. Over the same period, the S&P 500 saw a peak-to-trough swing that was 3.5 times greater than the swing in Porter's portfolio. The maximum loss was nearly five times greater in the S&P 500.

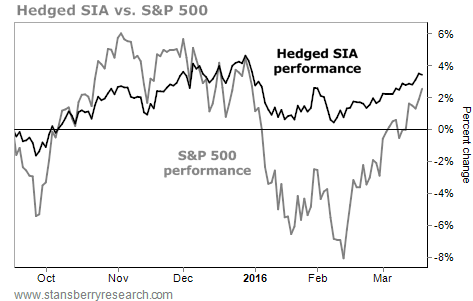

Take a look at the following chart, which shows this incredible difference at work...

It doesn't take a genius to see that Porter's portfolio has produced the better risk-adjusted returns by far. When your risk is lower AND your returns are higher, it's hard to argue. Porter used several strategies to lower his subscribers' risk without sacrificing their returns...

Regardless if the huge bear market that Porter has been predicting shows up, it's always a good time to take a close look at your own portfolio and see where you might need to make adjustments. Regards,

Further Reading:

Earlier this year, Richard showed why trailing stops should be at the heart of any great risk-management plan. Richard asks "are you ready to double down on your commitment to be a disciplined investor?" See what he's talking about here.

Porter says another crucial part of successful investing is risk-adjusted position sizing. "This idea is the single most amazing thing I've ever learned about finance," he says. "It's simple. It's incredibly safe. And it will make you truly huge amounts of money." Get all the details right here.

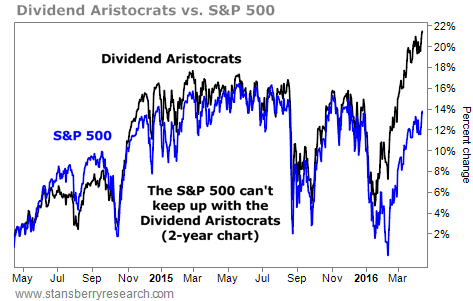

Market Notes'DIVIDEND ARISTOCRATS' MARCH HIGHER Today's chart shows the power of investing in companies that pay steady, growing dividends...

A dividend is money a company pays its shareholders. Every quarter, the company counts its earnings and pays out some portion to you, the owner. Essentially, it's your cut of the profits. As we've explained over the years, dividends are vital to the overall returns of your portfolio.

Companies that have increased their dividend payout for the past 25-plus years are part of an elite group called the "Dividend Aristocrats." We've covered many of them in DailyWealth over the past few months, including water-utility stock American States Water, soft-drink titan Coca-Cola, health care giant Johnson & Johnson, and most recently, medical-device maker Becton Dickinson.

The ProShares S&P 500 Dividend Aristocrats Fund (NOBL) is an exchange-traded fund that holds the Dividend Aristocrats. It's a "one click" way to get an idea of how these dividend stalwarts are performing. And as you can see below, these high-quality businesses continue to beat the market. Over the past seven months, shares of NOBL are up 12%... almost double the return of the S&P 500. And the fund just hit a new all-time high. Dividend investing may not be exciting, but it works!

|

Recent Articles

|